Withdraw cash from ATM using UPI; follow 5 steps to do so.

September 7th 2023.

Digital is the future, and we are now living in that future! Are you someone who loves the convenience of paying bills via the Unified Payments Interface (UPI)? Well, you'll be glad to know that UPI can now be used for cash withdrawals too.

This revolutionary UPI ATM was unveiled at the Global Fintech Fest in Mumbai. It has been developed by the National Payments Corporation of India and powered by NCR Corporation. While it hasn't been publicly deployed yet, it will be rolled out in phases.

Union Minister Piyush Goyal was so impressed with the UPI ATM that he shared a video of it on Twitter. The video showed Ravisutanjani, a FinTech influencer, demonstrating how to withdraw cash from an ATM using UPI. The caption read, "UPI ATM: The future of fintech is here!"

Dubbed 'India's first UPI ATM', this new age ATM eliminates the need to carry physical ATM cards. So, no more stressing about having to carry cards in case of emergency cash withdrawals. It is currently supported on the BHIM UPI app, and will soon be available on other apps like Google Pay, PhonePe, and Paytm.

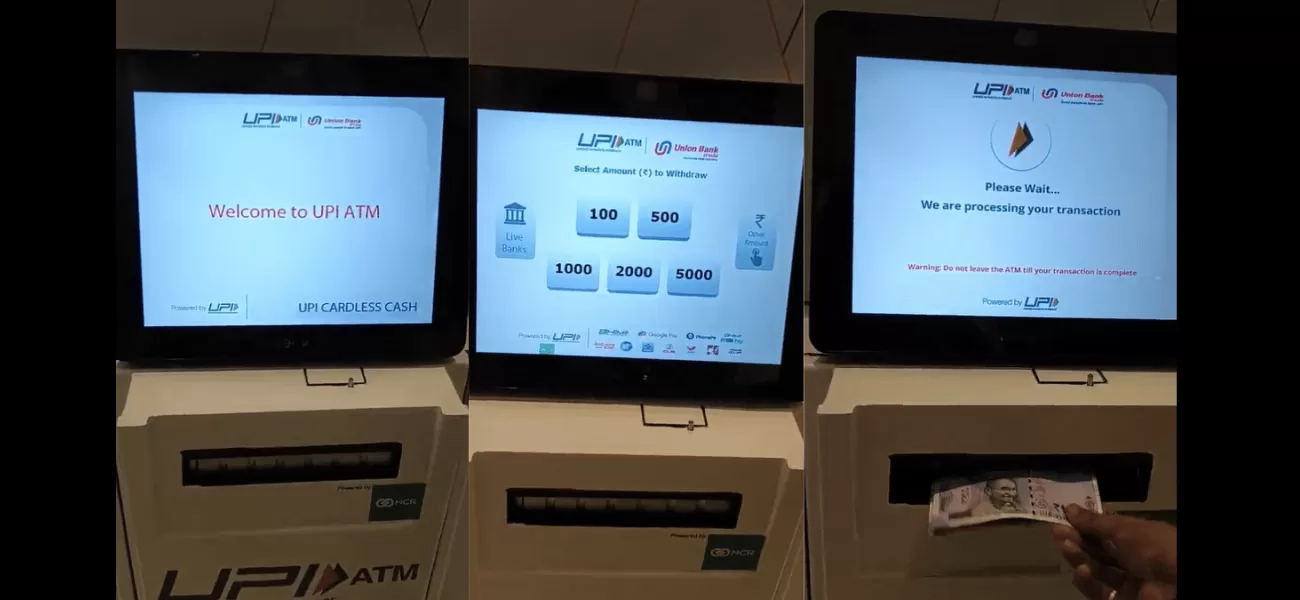

To withdraw cash from a UPI ATM, follow these five simple steps:

Step 1: Select the Cardless Cash option.

Step 2: Select the amount from the options displayed.

Step 3: Scan the QR code using your UPI app.

Step 4: Enter your UPI PIN to authorize the transaction.

Step 5: Collect your cash.

The UPI ATM is indeed a game-changer and has already taken the fintech industry by storm. It is a great example of how technology can make our lives easier and more convenient.

If you'd like to save money every month, there are seven wise and simple ways to do it. Start by tracking your expenses, and create a budget that you can stick to. You can also look for ways to lower your bills, such as switching to a cheaper phone plan or negotiating for lower rates on insurance premiums. Additionally, put aside some money for an emergency fund, and start investing in stocks or mutual funds. Finally, look into signing up for a rewards credit card, and take advantage of cash back offers.

This revolutionary UPI ATM was unveiled at the Global Fintech Fest in Mumbai. It has been developed by the National Payments Corporation of India and powered by NCR Corporation. While it hasn't been publicly deployed yet, it will be rolled out in phases.

Union Minister Piyush Goyal was so impressed with the UPI ATM that he shared a video of it on Twitter. The video showed Ravisutanjani, a FinTech influencer, demonstrating how to withdraw cash from an ATM using UPI. The caption read, "UPI ATM: The future of fintech is here!"

Dubbed 'India's first UPI ATM', this new age ATM eliminates the need to carry physical ATM cards. So, no more stressing about having to carry cards in case of emergency cash withdrawals. It is currently supported on the BHIM UPI app, and will soon be available on other apps like Google Pay, PhonePe, and Paytm.

To withdraw cash from a UPI ATM, follow these five simple steps:

Step 1: Select the Cardless Cash option.

Step 2: Select the amount from the options displayed.

Step 3: Scan the QR code using your UPI app.

Step 4: Enter your UPI PIN to authorize the transaction.

Step 5: Collect your cash.

The UPI ATM is indeed a game-changer and has already taken the fintech industry by storm. It is a great example of how technology can make our lives easier and more convenient.

If you'd like to save money every month, there are seven wise and simple ways to do it. Start by tracking your expenses, and create a budget that you can stick to. You can also look for ways to lower your bills, such as switching to a cheaper phone plan or negotiating for lower rates on insurance premiums. Additionally, put aside some money for an emergency fund, and start investing in stocks or mutual funds. Finally, look into signing up for a rewards credit card, and take advantage of cash back offers.

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment