Zillow's climate risk data benefits Colorado home buyers.

Climate risks driving up home insurance rates in Colorado, prompting 90% of homebuyers in the West to consider these factors when purchasing a home. Zillow now includes climate risk data in property listings.

October 25th 2024.

The real estate market in the western United States is feeling the impacts of climate change as wildfires and hail damage continue to rise. In fact, a staggering 90% of prospective homebuyers in the West are now considering at least one climate risk factor when purchasing a home. With this growing concern in mind, Zillow has recently incorporated climate risk data from First Street Foundation, a nonprofit organization, into their for-sale property listings across the country.

This new feature offers home shoppers valuable insights into five key risks: flood, wildfire, wind, heat, and air quality. By providing risk scores, interactive maps, and information about insurance requirements, Zillow aims to help buyers make informed decisions when it comes to choosing a home. According to Skylar Olsen, Zillow's chief economist, climate risks have become a critical factor in home-buying decisions, and it's crucial for both buyers and sellers to have access to all the relevant data for their choices. This tool not only benefits buyers but also helps agents inform their clients about climate risk, insurance, and long-term affordability.

The data shows that climate risk is not just a concern for the present, but it's also on the rise. A recent analysis by Zillow found that there has been an increase in significant climate risk in new home listings across all five categories when compared to listings from five years ago. For example, 17% of new listings in August indicated a significant risk of wildfires. This trend is alarming and demands attention from both buyers and insurance companies.

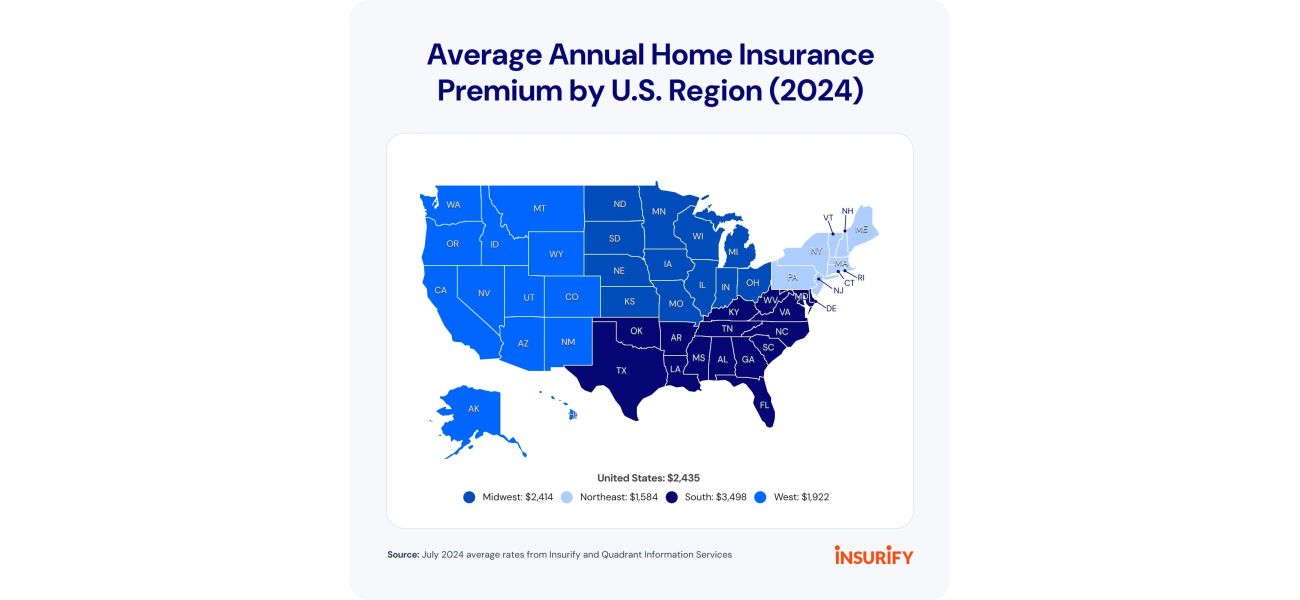

Speaking of insurance, it's no surprise that climate-related weather damage is driving up insurance rates all over the country. According to a study by Insurify, a digital insurance agent, homeowners in 15 states, including Colorado, can expect to see continued weather-related rate hikes and a decline in competition from insurance companies. In fact, Colorado has the second-highest property damage losses to hail, estimated at $151 million annually. The state also has over 321,000 homes at risk of wildfires, with a reconstruction cost of $141 billion.

As a result, home insurance premiums in Colorado are among the highest in the nation, with an average of $4,186. To make matters worse, in 2022, 76% of insurers scaled back their coverage in high-risk areas, leading to higher premiums and fewer options for homeowners. This struggle for insurance companies is due to natural disaster claims exceeding the premium increases. In response, some states, like Florida, have created state-run insurance programs for high-risk homeowners.

In 2023, Colorado legislators passed the Colorado Fair Access to Insurance Requirements (FAIR) Plan, which is set to launch in 2025. This property insurance program aims to cover individuals and businesses in areas prone to natural disasters or other risks that cannot obtain traditional insurance. However, to qualify for the FAIR Plan, homeowners must receive multiple denial letters from insurers and take steps to reduce wildfire risk. These policies typically offer less coverage at a higher cost and are designed as a last resort until alternative coverage is found.

In light of these rising insurance costs, it's crucial for homeowners to take steps to lower their premiums. Chase Gardner, the data insights manager at Insurify, suggests shopping around and comparing policies to get the best rate. Since different companies calculate risk differently, homeowners may find a lower rate with a different insurer. He also advises purchasing a separate disaster policy to cover severe hail or weather events, which allows for a higher home insurance deductible. This strategy can save homeowners hundreds of dollars on their policy.

Additionally, Gardner recommends investing in stormproof windows and a metal roof, which is significantly more hail-resistant than a standard shingle roof. These proactive measures not only help protect against potential damage but can also lead to lower insurance premiums. It's essential for homeowners to stay informed and take necessary steps to prepare for climate risks in order to get the best deal on their insurance.

This new feature offers home shoppers valuable insights into five key risks: flood, wildfire, wind, heat, and air quality. By providing risk scores, interactive maps, and information about insurance requirements, Zillow aims to help buyers make informed decisions when it comes to choosing a home. According to Skylar Olsen, Zillow's chief economist, climate risks have become a critical factor in home-buying decisions, and it's crucial for both buyers and sellers to have access to all the relevant data for their choices. This tool not only benefits buyers but also helps agents inform their clients about climate risk, insurance, and long-term affordability.

The data shows that climate risk is not just a concern for the present, but it's also on the rise. A recent analysis by Zillow found that there has been an increase in significant climate risk in new home listings across all five categories when compared to listings from five years ago. For example, 17% of new listings in August indicated a significant risk of wildfires. This trend is alarming and demands attention from both buyers and insurance companies.

Speaking of insurance, it's no surprise that climate-related weather damage is driving up insurance rates all over the country. According to a study by Insurify, a digital insurance agent, homeowners in 15 states, including Colorado, can expect to see continued weather-related rate hikes and a decline in competition from insurance companies. In fact, Colorado has the second-highest property damage losses to hail, estimated at $151 million annually. The state also has over 321,000 homes at risk of wildfires, with a reconstruction cost of $141 billion.

As a result, home insurance premiums in Colorado are among the highest in the nation, with an average of $4,186. To make matters worse, in 2022, 76% of insurers scaled back their coverage in high-risk areas, leading to higher premiums and fewer options for homeowners. This struggle for insurance companies is due to natural disaster claims exceeding the premium increases. In response, some states, like Florida, have created state-run insurance programs for high-risk homeowners.

In 2023, Colorado legislators passed the Colorado Fair Access to Insurance Requirements (FAIR) Plan, which is set to launch in 2025. This property insurance program aims to cover individuals and businesses in areas prone to natural disasters or other risks that cannot obtain traditional insurance. However, to qualify for the FAIR Plan, homeowners must receive multiple denial letters from insurers and take steps to reduce wildfire risk. These policies typically offer less coverage at a higher cost and are designed as a last resort until alternative coverage is found.

In light of these rising insurance costs, it's crucial for homeowners to take steps to lower their premiums. Chase Gardner, the data insights manager at Insurify, suggests shopping around and comparing policies to get the best rate. Since different companies calculate risk differently, homeowners may find a lower rate with a different insurer. He also advises purchasing a separate disaster policy to cover severe hail or weather events, which allows for a higher home insurance deductible. This strategy can save homeowners hundreds of dollars on their policy.

Additionally, Gardner recommends investing in stormproof windows and a metal roof, which is significantly more hail-resistant than a standard shingle roof. These proactive measures not only help protect against potential damage but can also lead to lower insurance premiums. It's essential for homeowners to stay informed and take necessary steps to prepare for climate risks in order to get the best deal on their insurance.

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment