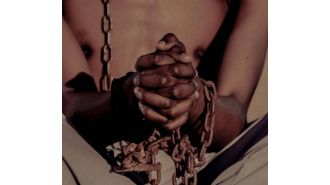

Trump's recent decision to end the pause on late payment tracking has resulted in a rise in student loan defaults, disproportionately affecting Black borrowers.

Black students have a disproportionate amount of loan debt compared to their population size.

The latest household debt report from the New York Federal Reserve, released on May 13, revealed a significant increase in student loan delinquencies. This surge comes on the heels of the Trump administration's decision to end the Biden-era pause on reporting missed payments.

According to the Fed, a serious delinquency occurs when a borrower misses payments for 90 days or more. The rate of serious federal student loan delinquencies jumped from 1% in the first quarter of 2024 to nearly 8% in the same period of 2025, coinciding with the resumption of delinquency reporting.

In a news release, Daniel Mangrum, a research economist at the New York Fed, commented on the report, noting the increase in delinquencies. "Transition rates into serious delinquency have leveled off for credit card and auto loans over the past year," Mangrum said. "However, the first batch of past due student loans were reported in the first quarter of 2025, resulting in a large jump in seriously delinquent borrowers."

During the height of the pandemic in 2020, student loan payments and delinquency tracking were paused, and borrowers were given a one-year transition period when payments resumed in late 2023. This provided some relief for borrowers, but the renewal of student loan reporting has contributed to the highest level of consumer debt in five years.

The issue of student loan debt is particularly prevalent among Black individuals, who are overrepresented relative to their share of the population. According to the Education Data Initiative, Black college graduates owe an average of $25,000 more than white college graduates. Four years after graduation, Black students owe an average of 188% more in student loan debt than their white counterparts. Furthermore, Black student loan borrowers are the most likely to struggle financially due to their debt, with an average monthly payment of $258.

Additionally, half of all Black student loan borrowers have indicated that their debt exceeds their net worth, while 52% of Asian and white borrowers reported the opposite. These statistics highlight the socio-economic disparities that exist in the United States when it comes to finances and wealth.

Donna Rasmussen, the executive director of the Consumer Credit Counseling Service of Northern Illinois, explained that the average federal student loan debt, including both private and federal loans, is approximately $38,500. Rasmussen also pointed out that competing increases in the cost of living have led many borrowers to stop making their student loan payments. "Rents have increased to a crazy amount. Car insurance, all those things have increased," she told ABC 7 Chicago. "We often hear from people who say, 'We'd rather be in debt than homeless.' So, they prioritize their food, car payments, and other essential items over their student loan payments."

Rasmussen also shared what typically happens once a borrower is considered in default on their student loans. "If you haven't made a payment in 90 days, then you should know that you're in default. You will receive a notice, either in the mail or email, with options on what to do," she explained. "With student loan debt, they don't have to go to court. You'll get a notice that your wages will be garnished."

In an effort to avoid this outcome, borrowers are encouraged to contact the Education Department's default resolution group to make a monthly payment, enroll in an income-driven repayment plan, or sign up for loan rehabilitation. However, due to budget cuts under the Trump administration, some are having difficulty accessing the Education Department for assistance.

Despite the challenges faced by student loan borrowers, the Education Department is warning the public to be cautious of scammers who may try to take advantage of their desperation. "If you are contacted by a company asking you to pay 'enrollment,' 'subscription,' or 'maintenance' fees to help you get out of default, you should walk away," the Education Department states on its website. "Your loan holder will assist you with your defaulted loan for free."

In conclusion, with the rising costs of education and the economic impact of the pandemic, it is crucial for borrowers to be aware of their options and seek assistance from legitimate sources. No one should have to sacrifice their financial stability to pursue higher education.

1 Views