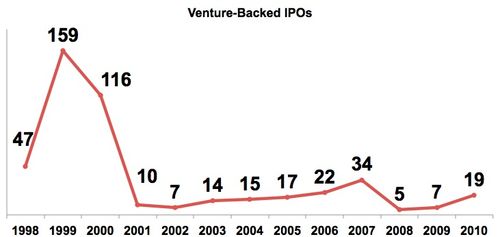

There Aren't Many Venture Backed IPOs

As a follow up to yesterday's post on this topic, here's another chart from Mark Suster:

So using the math I laid out yesterday (roughly 1,000 startups funded each year by VCs), this means that on average between 1% and 3% of venture funded startups get to an IPO.

To recap, 1-3% get to an IPO and 5-10% get to an M&A exit over $100mm. So 85-95% of all venture backed startups will either fail or exit below $100mm.

I am certain the VC industry is not using this probability of outcome in setting valuations right now.

4 Views