The "Doubling Model" For Fundraising

I was talking to a friend this past week who is looking at an early stage company and trying to figure out how to value it.

He pointed to a similar company that has a public market cap of $250mm.

I asked him how many rounds of financing or how many major milestones does this early stage business need to accomplish before it can get to the same place the similar publicly traded company is at.

He said he thought it was going to take three big steps after this financing to get there.

So I said, “it is worth roughly $30mm after this round.”

He said “how did you determine that?”

I said “If you assume the value will double from round to round or milestone to milestone, and after three more of those it will be worth $250mm, then it should be worth $30mm after this one.”

I then said “work back from $250mm, to $125mm, to $62mm to $31mm.”

I call this the doubling model and I’ve used it as a framework for thinking about value appreciation in startup financing for over thirty years.

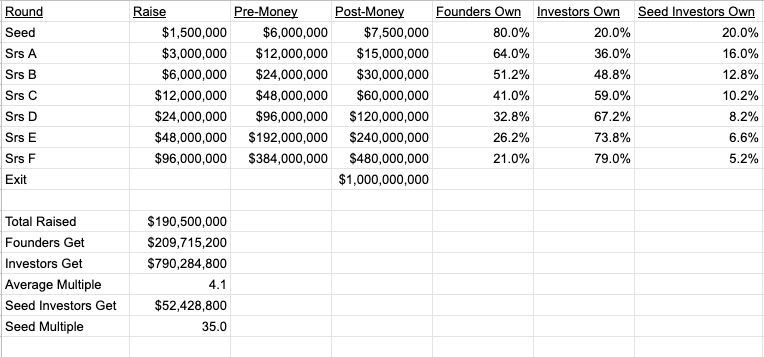

Here is a simple spreadsheet that shows how this works. It does not include the impact of employee equity grants in it so the numbers would change a bit if I added that. Assume the employees would own 20% of the company at exit.

This is just a framework, nothing more.

But I find it is very helpful in thinking about what is fair and reasonable at various stages of a companies development.

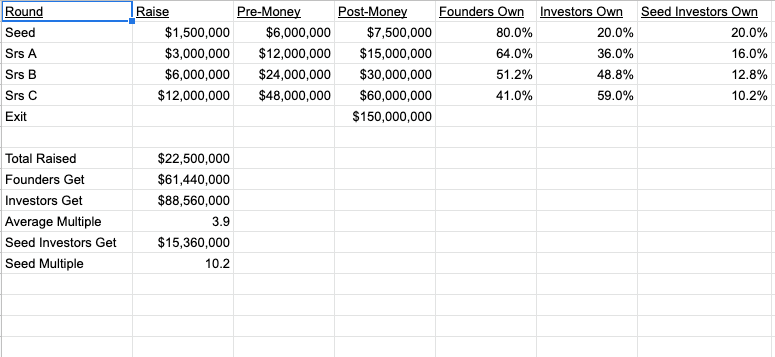

You can also scale this back. If a company only needs ~$20mm to get to positive cash flow, but only has $150mm of potential value at exit, you would get something like this:

The two big assumptions that drive this framework is that a company should always target to double valuation round to round and never dilute more than 20% per round. That minimizes dilution and also gives the existing investors the comfort and confidence that things are going roughly to plan.

If things are going great, you can take valuation up more than that from round to round, but in my experience that often catches up to you and the next round is flat as a result, which is not a great thing for anyone.

And everything is ultimately governed by the total size of the opportunity (TAM), how the market will value that at time of exit, and the capital requirements to get there. Those are the fundamental drivers of value in startup land and this framework attempts to respect them.