Price Stability

One of the use cases that has eluded cryptocurrencies to date is “means of exchange” (something you would spend).

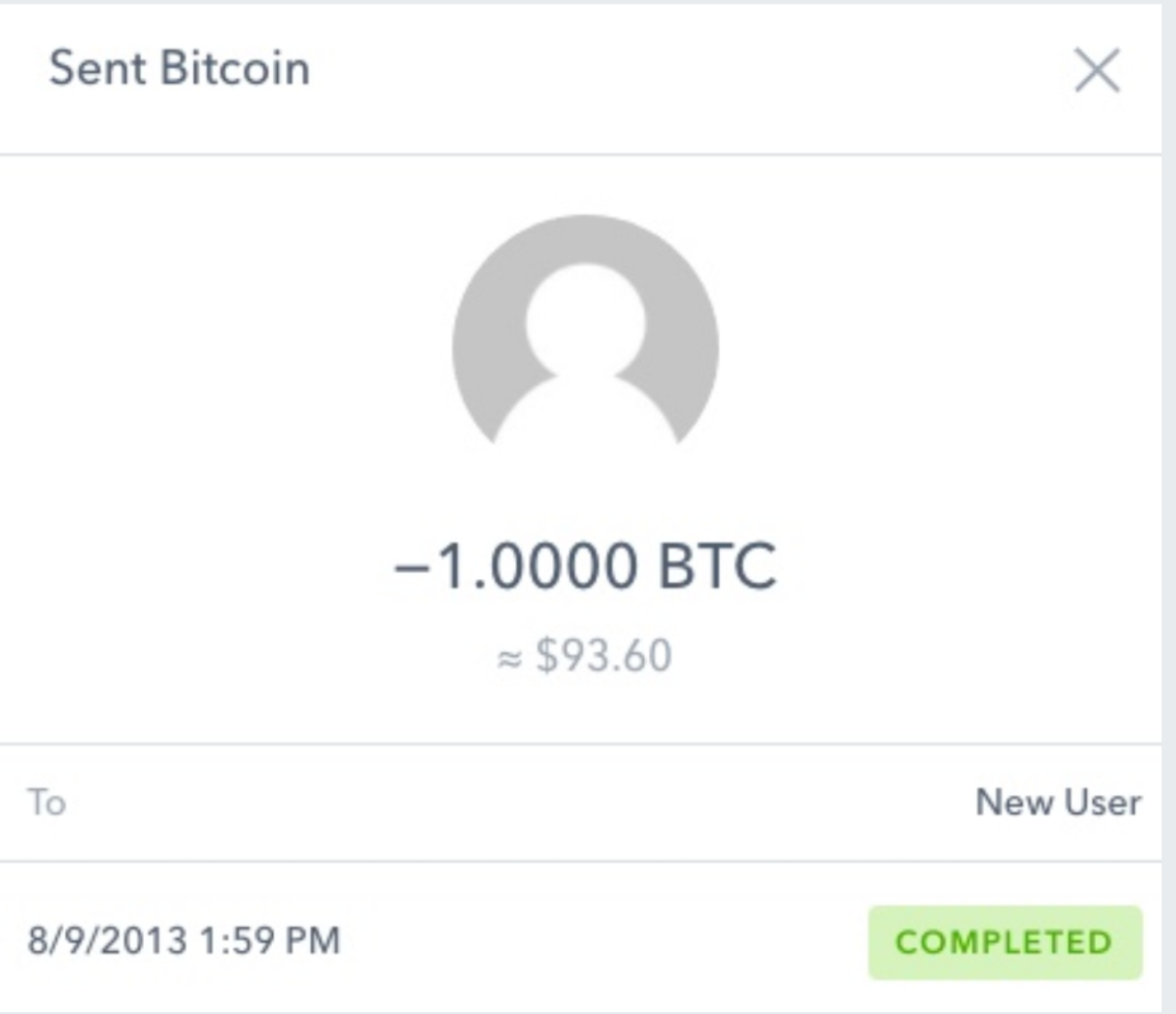

I wrote about this a couple years ago and showed this transaction in that blog post:

That was a payment I made to a caddie named Kris after he carried my bags one morning six years ago.

We played today and he was carrying a friend’s bag and I asked him if he still had that Bitcoin and he smiled and said “absolutely.”.

That made me feel good but the truth is nobody should be paying for anything, including caddying services, with something that can appreciate 123x. That’s just not rationale behavior.

Which is why stablecoins, cryptocurrencies which have price stability built in to them, are one of the important sectors in crypto right now.

There is the “dollar pegged” approach, like Tether (which may not actually be dollar pegged) and USDC (which is actually dollar pegged). One of the issuers of USDC is Coinbase, a USV portfolio company.

There is the Libra cryptocurrency, which USV is involved with as a Founding Member of the Libra Association. Libra will not be pegged to a specific fiat currency, but will have a reserve made up of many fiat currencies so it will have price stability.

And then there are stablecoins that are asset backed but not fiat backed like Dai.

Finally there are stablecoins that attempt to deliver price stability programmatically. I am not confident that approach will work.

I am confident that one way or another consumers will adopt cryptocurrencies that are price stabilized and when they do they will start transacting in them. And that will unlock a lot of utility that has so far been elusive.