Not All Gross Margin Is The Same

I wrote a blog post in September of last year arguing that gross margins and operating margins really matter when valuing companies. I argued that “software companies with software margins” are better businesses than tech companies that are not really software companies but a tech-enabled version of some other business.

But gross margins, in particular, can be tricky to compare. In some cases, a software business is in the middle of the revenue flow, takes the revenue, and then passes on a lot of it, and is left with what looks like a low margin, but is in fact a high margin.

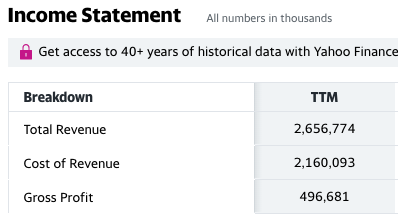

An example of that is the Dutch payment processing company Adyen. Here is a screenshot of a part of Adyen’s income statement from Yahoo Finance:

So Adyen operated in the last twelve months with an 18.7% gross margin. Many would think that was a “very low margin business.” But the truth is Adyen is simply passing through that $2.1bn of revenue to financial institutions in the form of interchange and other fees. They do very little with that money.

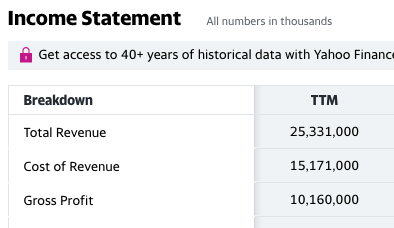

Let’s compare that with the big retailer Macy’s. Here is a screenshot of a part of Macy’s income statement from Yahoo Finance:

So Macy’s operated at a 40.1% gross margin over the last twelve months, more than double what Adyen operated at.

That $15bn cost of revenue on Macy’s Income Statement is the cost of purchasing everything you might find in a Macy’s store, the inventory costs associated with that, and the cost and effort of displaying all of that inventory in the stores.

So while it is the case that Macy’s has more than double the gross margin of Adyen, I believe Adyen has a much more attractive business from a margin perspective than Macy’s.

That is because Macy’s expends enormous amounts of working capital and operating expense and effort in its $15bn cost of revenue where Adyen expends very little working capital and operating expense and effort in its $2.1bn cost of revenue.

The trick, I think, is to wrap your head around the cost of revenue or cost of goods sold line item in the income statement and think about what is going on there. If it is very little to no effort, and largely just an accounting entry, then you may have a “low margin business” that is actually a high margin business. On the other hand, if it is a lot of work and capital investment to produce those margins, well then you have what you have and that is often a low margin business.

.jpg)