NC & Justice Dept. settle for $13.5M with bank over redlining allegations.

The Justice Department and North Carolina have settled with a bank for $13.5 million over accusations of redlining.

February 8th 2024.

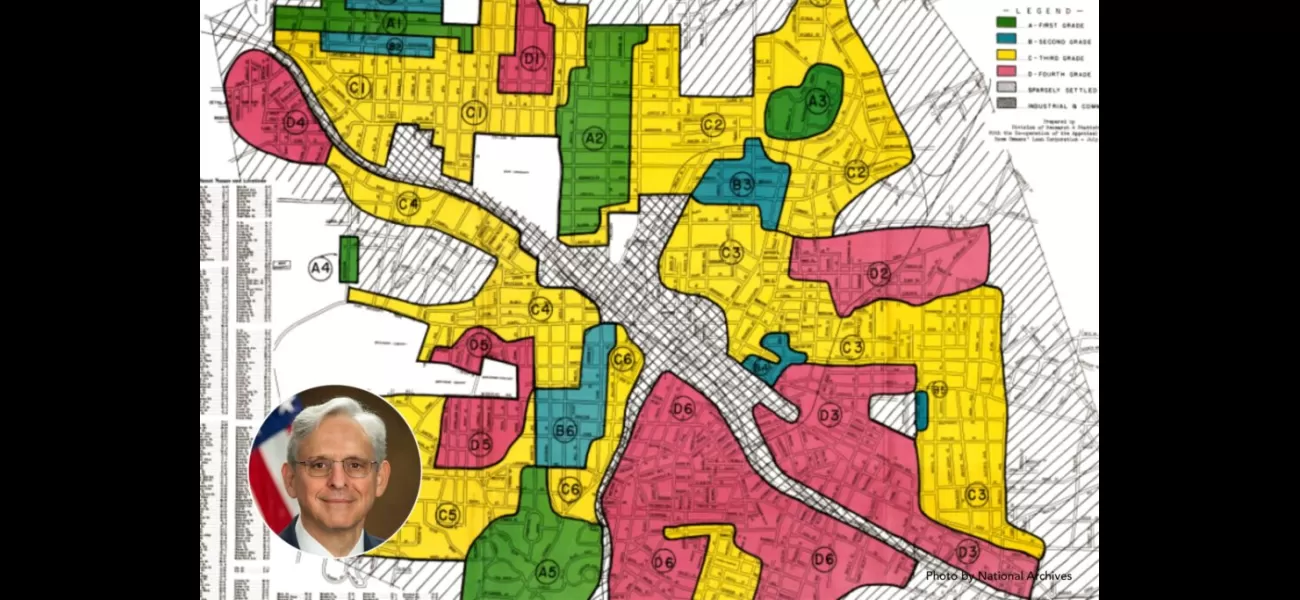

The Justice Department and the State of North Carolina have recently come to a significant agreement with the First National Bank of Pennsylvania, after accusing the bank of engaging in a discriminatory practice known as redlining in predominantly Black and Hispanic neighborhoods in Charlotte and Winston-Salem. This practice involves directing Black homebuyers and renters to certain areas while steering them away from others, and it has been a long-standing issue in the housing market since its origins in the 1930s.

Attorney General Merrick Garland spoke out about the seriousness of lending discrimination, stating that it not only violates the law but also has long-lasting effects on entire communities and families. As a result of the settlement, the bank has agreed to pay $13.5 million, which will be used to expand access to credit services in Charlotte and Winston-Salem. This marks a significant step in the Justice Department's Combating Redlining Initiative, which has now secured over $122 million in relief for communities across the country.

Under the terms of the settlement, the First National Bank of Pennsylvania has committed to several actions, including investing at least $11.75 million in a loan subsidy fund to increase access to home loans for residents of majority-Black and Hispanic neighborhoods in Charlotte and Winston-Salem. They will also be spending $1 million on community partnerships to provide credit and financial education services, as well as $750,000 for advertising and outreach efforts in these communities. Additionally, the bank plans to open three new branches in predominantly Black and Hispanic neighborhoods and hire a director of community lending to oversee their efforts in these areas.

Redlining has been a major issue in the housing market for decades, with real estate agents often directing Black homebuyers and renters to certain neighborhoods while avoiding others. This discriminatory practice was first established in the 1930s with government homeownership programs, and it has continued to be a problem in many communities. The Justice Department's efforts to combat redlining by banks across the country are an important step towards addressing this issue.

The complaint against the First National Bank of Pennsylvania alleges that between 2017 and 2021, the bank failed to provide mortgage lending services to Black and Hispanic neighborhoods in Charlotte and Winston-Salem and discouraged them from seeking credit. Instead, their home mortgage lending was disproportionately focused on white areas in these cities. The Justice Department found that other lenders were generating applications in predominantly Black and Hispanic neighborhoods at a much higher rate than FNB, highlighting the bank's discriminatory practices.

In addition to the disparities in lending services, the bank's branches were also overwhelmingly located in predominantly white neighborhoods. The bank's sole branch in a predominantly Black and Hispanic neighborhood in Winston-Salem was closed in 2021, further limiting access to credit for these communities. This is a concerning issue, especially in the case of Princeville, North Carolina, the oldest Black town in the United States, which has been facing the threat of floods and is in need of resources and support.

The settlement between the Justice Department, North Carolina, and the First National Bank of Pennsylvania is a step in the right direction towards addressing redlining and promoting fair lending practices. However, there is still much work to be done, and the Justice Department remains committed to combating discrimination in lending wherever it occurs. As we continue to fight for equal access to credit and homeownership, we must also recognize and address the systemic issues that perpetuate these disparities in our communities.

Attorney General Merrick Garland spoke out about the seriousness of lending discrimination, stating that it not only violates the law but also has long-lasting effects on entire communities and families. As a result of the settlement, the bank has agreed to pay $13.5 million, which will be used to expand access to credit services in Charlotte and Winston-Salem. This marks a significant step in the Justice Department's Combating Redlining Initiative, which has now secured over $122 million in relief for communities across the country.

Under the terms of the settlement, the First National Bank of Pennsylvania has committed to several actions, including investing at least $11.75 million in a loan subsidy fund to increase access to home loans for residents of majority-Black and Hispanic neighborhoods in Charlotte and Winston-Salem. They will also be spending $1 million on community partnerships to provide credit and financial education services, as well as $750,000 for advertising and outreach efforts in these communities. Additionally, the bank plans to open three new branches in predominantly Black and Hispanic neighborhoods and hire a director of community lending to oversee their efforts in these areas.

Redlining has been a major issue in the housing market for decades, with real estate agents often directing Black homebuyers and renters to certain neighborhoods while avoiding others. This discriminatory practice was first established in the 1930s with government homeownership programs, and it has continued to be a problem in many communities. The Justice Department's efforts to combat redlining by banks across the country are an important step towards addressing this issue.

The complaint against the First National Bank of Pennsylvania alleges that between 2017 and 2021, the bank failed to provide mortgage lending services to Black and Hispanic neighborhoods in Charlotte and Winston-Salem and discouraged them from seeking credit. Instead, their home mortgage lending was disproportionately focused on white areas in these cities. The Justice Department found that other lenders were generating applications in predominantly Black and Hispanic neighborhoods at a much higher rate than FNB, highlighting the bank's discriminatory practices.

In addition to the disparities in lending services, the bank's branches were also overwhelmingly located in predominantly white neighborhoods. The bank's sole branch in a predominantly Black and Hispanic neighborhood in Winston-Salem was closed in 2021, further limiting access to credit for these communities. This is a concerning issue, especially in the case of Princeville, North Carolina, the oldest Black town in the United States, which has been facing the threat of floods and is in need of resources and support.

The settlement between the Justice Department, North Carolina, and the First National Bank of Pennsylvania is a step in the right direction towards addressing redlining and promoting fair lending practices. However, there is still much work to be done, and the Justice Department remains committed to combating discrimination in lending wherever it occurs. As we continue to fight for equal access to credit and homeownership, we must also recognize and address the systemic issues that perpetuate these disparities in our communities.

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment