How This Ends

Back in February of last year, I wrote a blog post with the same title and said this about the asset price bubble we were living in and investing in over the last few years:

The big question is how does this end?

I believe it ends when the Covid 19 pandemic is over and the global economy recovers. Those two things won’t necessarily happen at the same time. There is a wide range of recovery scenarios and nobody really knows how long it will take the global economy to recover from the pandemic.

But at some point, economies will recover, central banks will tighten the money supply, and interest rates will rise. We may see price inflation of consumer goods and labor too, although that is less clear.

When economies recover and interest rates rise, the air will come out of the asset price bubbles that have built up and the go go markets will hit the brakes.

Well now the markets have hit the brakes and the new question is how that ends.

I have been using the early 80s as a bit of a mental model. The late 70s saw oil prices rise and stagflation emerge and while that is not exactly what has happened with COVID and the war in Ukraine, there are some similarities.

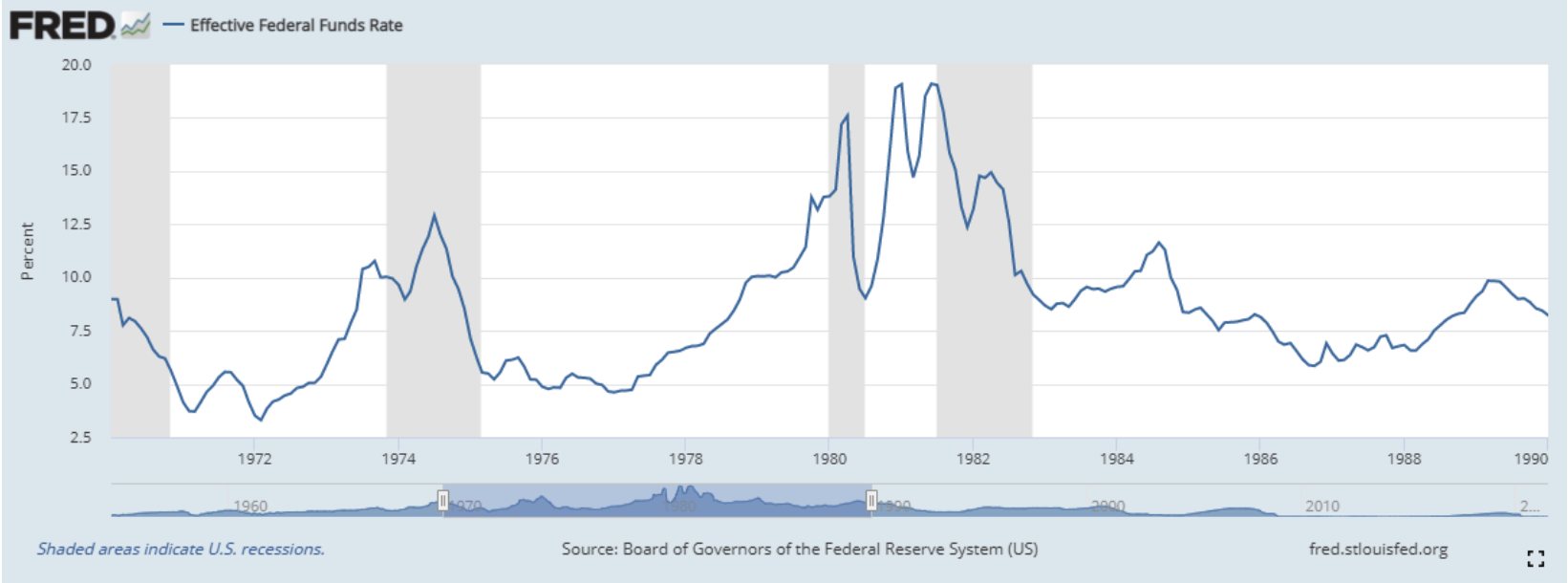

In the early 80s, the G7 economies tightened the money supply, raising interest rates dramatically, in an effort to bring inflation under control. You can see the effect in this image:

The early 80s had a double dip recession (one in 1980 and another one for 18 months in 1981 and 1982). The economy was weak for three years at the start of the decade. But the latter half of the decade was one of the best economies in modern times.

So I suspect we are either in a recession right now or headed to one, brought on by tightening money supply/higher rates that are being used to control inflation. That recession could easily last until the end of 2023. But we don’t really know how long it will take for this cycle to play out.

Markets have already corrected and I think that public tech stocks have already seen most of the damage they are going to see. I don’t know if we have hit bottom but I think we are closer to the bottom than the top now. But that does not mean they will turn around and go right back up.

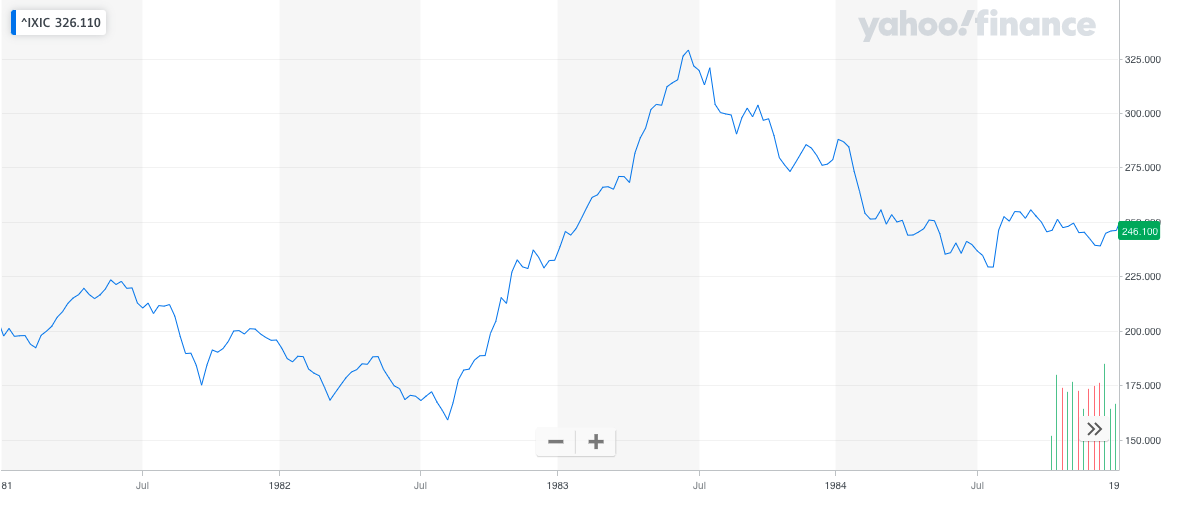

This is a price chart of the NASDAQ during the early 80s recession and you can see that prices did not start to move up until the second half of 1983, when the recession was starting to end.

So how does this market meltdown that we are now in end?

First, we need to see the economy slow down and inflation slow down. We need to see stocks bottom out and hang out there for a while. And we need to be patient. None of this is going to happen fast.

I would be planning to ride this thing out for at least eighteen months or more.

.jpg)