American Kingpin

I read my friend Nick Bilton‘s book American Kingpin over the last few weeks. It is the story of Ross Ulbricht (aka Dread Pirate Roberts), the founder and owner of The Silk Road.

It is a fascinating story with many angles; drug and arms dealing, entrepreneurship, criminal investigation, and much more. I highly recommend the book.

It reminded me that The Silk Road was the original product market fit for Bitcoin. According to Wikipedia:

The total revenue generated from these sales was 9,519,664 Bitcoins, and the total commissions collected by Silk Road from the sales amounted to 614,305 Bitcoins. These figures are equivalent to roughly $1.2 billion in revenue and $79.8 million in commissions, at current Bitcoin exchange rates…”, according to the September 2013 complaint, and involved 146,946 buyers and 3,877 vendors

https://en.wikipedia.org/wiki/Silk_Road_(marketplace)

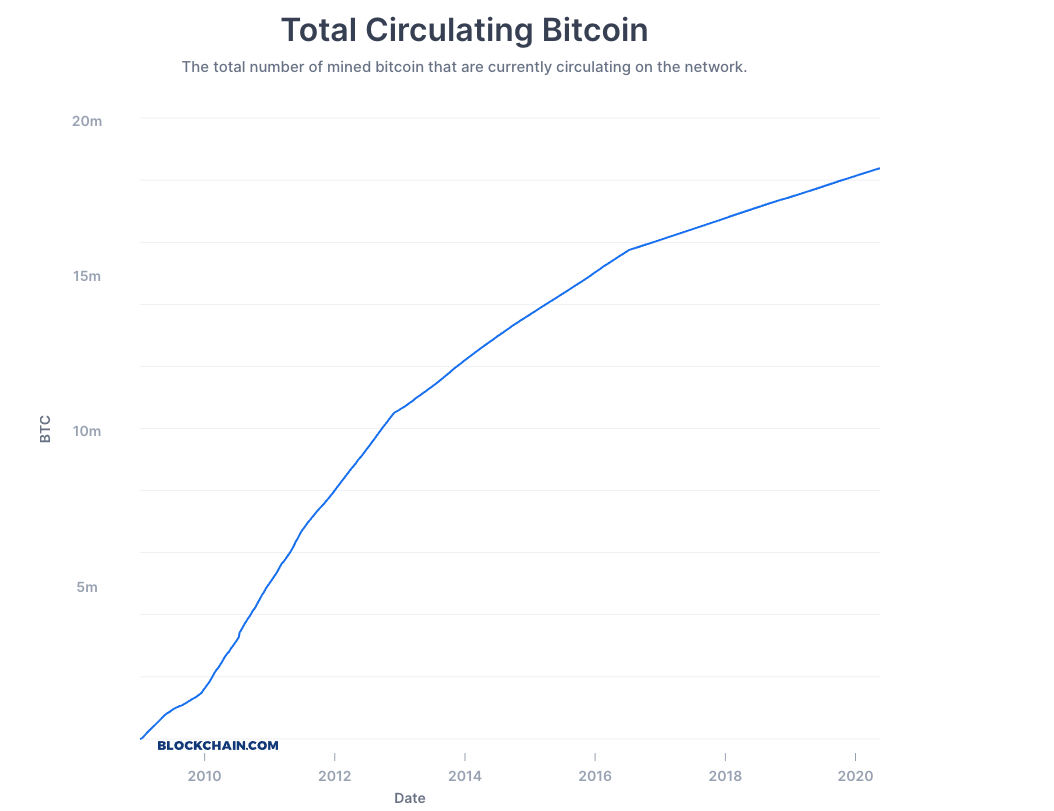

Those 9.5mm bitcoins, which certainly recirculated a fair bit, represented roughly all of the circulating supply of Bitcoin at that time.

That does not mean that all of the bitcoins that had been mined at that time were in use on The Silk Road. A much smaller percentage of them recirculated back and forth between customers and suppliers in the market.

But I have always believed that The Silk Road was where Bitcoin first found a massive use case and it was where many people first bought and used Bitcoin.

This has led to a narrative around Bitcoin and crypto that it is shady and only useful for illicit behavior. That is unfortunate and not true.

Many technologies that ultimately find mainstream use cases (the web browser, the VHS, etc) find initial product market fit in areas that are edgy at best. And such was the case with Bitcoin and crypto.

These “edgy” use cases prove out the technology, provide an initial user base, and lead to more mainstream adoption down the road. And that is what happened with Bitcoin and The Silk Road.