A Failing Grade

I wrote yesterday, about the quarterly numbers for VC investing activity:

If this was a student coming home with a report card, it would be straight As.

Well, I missed something in the data that was subsequently reported on by PitchBook, one of the authors of the report:

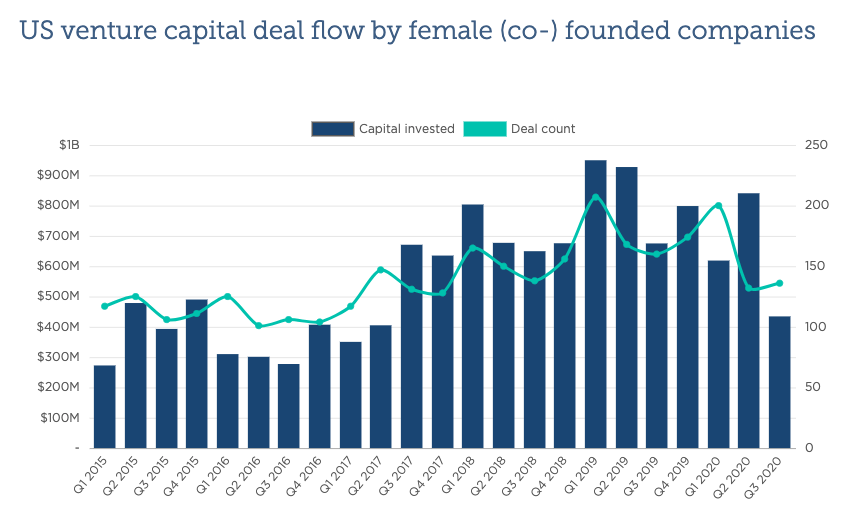

Venture funding for female founders has hit its lowest quarterly total in three years.

Firms invested a total of $434 million in Q3—the lowest figure since the second quarter of 2017, according to PitchBook data. The third quarter total also amounts to a 48% drop in funding from Q2, when female founders received $841 million across 132 deals.

https://pitchbook.com/news/articles/vc-funding-female-founders-drops-low

I hope Q3 is an anomaly and not the reversal of a trend that has mostly been “up and to the right” in recent years.

We continue to see, and fund, great woman founders so I am hoping that there is not some fundamental change to the market that is hurting women founders. But it is possible that there is and I missed that in my blog yesterday. I will give myself an F for that.

I’ve seen a few replies on Twitter that suggest the same is true for underrepresented minorities. I have not seen the data to back that up but if it is true, that is also a failing grade for the VC sector.

I have been encouraged by what I have seen in the VC/startup sector regarding opening up access to women founders and founders of color. It feels like positive change is happening. But we have to see that in the numbers or it is just talk.

And apparently we did not see it in the numbers last quarter.