When Markets Overcorrect

When capital markets change direction, to the upside or to the downside, they often go too far before finding the right balance. When they overshoot to the downside, you can find some real values.

Back in the financial crisis of 2008, I was blogging about that as it related to the big tech stocks (Apple, Amazon, Google). The market hated everything and you could buy the big three tech franchises at crazy low prices as it related to their fundamentals (revenues, profits, cash flow, etc). And so I did and a lot of other people did too. And when the market came back in 2009 and beyond, those who bought at those bargain prices were rewarded.

So, it may be time to start thinking this way in crypto land. The reason I say “may” instead of “is” has to do with the fact that really bad bear markets take a while to find their footing and start moving up again. I worry that it will take crypto a while before it can make a move upward again. I wrote about that in this post a few weeks ago.

But nevertheless, I think it is time to at least start looking for fundamental value in crypto land. Ethereum is trading below $10bn. There are some traditional businesses in the crypto sector that are valued at almost that level. And if you believe in the fat protocols thesis, as I do, that gets my attention.

But there are more rigorous ways to think about fundamental value in crypto and one of the best known fundamental value thinkers in crypto is Chris Burniske, a partner in Placeholder, a crypto venture firm that USV is an investor in and I am an investor in too.

Chris posted a bunch of charts and analysis yesterday comparing Bitcoin and Ethereum to a bunch of measures of the fundamental value of their networks.

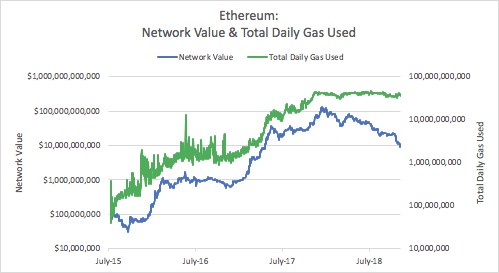

This chart from that post is the most telling in my view:

The green line is the use of gas to pay for smart contract execution on the Ethereum network. The blue line is the market cap of Ethereum. The growing gap between the green and blue lines represents, to me, the sign of market overshooting itself.

There remain some important fundamental questions about Ethereum so it is not like Apple, Google, and Amazon back in 2008. There is still existential risk in Ethereum. It could fail as a protocol and go to zero. So there are many reasons not to go all in on Ethereum right now.

But if you view Ethereum as a call option on the possibility that it will retain its role as the leading decentralized smart contract execution platform, then I think it is starting to look pretty compelling. And analysis like the work that Chris is doing is really helpful in determining things like that.