What’s a Pig Butchering Scam? Here’s How to Avoid Falling Victim to One.

Turning over the videos of police shooting at their fellow officer would “constitute an unwarranted invasion of personal privacy,” said the NYPD about why it refused to make the footage available to a reporter.

If you’re like most people, you’ve received a text or chat message in recent months from a stranger with an attractive profile photograph. It might open with a simple “Hi” or what seems like good-natured confusion about why your phone number seems to be in the person’s address book. But these messages are often far from accidental: They’re the first step in a process intended to steer you from a friendly chat to an online investment to, ultimately, watching your money disappear into the account of a fraudster.

“Pig butchering,” as the technique is known — the phrase alludes to the practice of fattening a hog before slaughter — originated in China, then went global during the pandemic. Today criminal syndicates target people around the world, often by forcing human trafficking victims in Southeast Asia to perpetrate the schemes against their will. ProPublica recently published an in-depth investigation of pig butchering, based on months of interviews with dozens of scam victims, former scam sweatshop workers, advocates, rescue workers, law enforcement and investigators, along with extensive documentary evidence including training manuals for scammers, chat transcripts between scammers and their targets and complaints filed with the Federal Trade Commission.

“We’ve had people from all walks of life that have been victimized in these cases and the paydays have been huge,” said Andrew Frey, a financial investigator for the Secret Service, the federal agency that is taking a lead role in combating online crime and trying to help victims recover their stolen funds.

These swindles are not only highly organized but also systematized. Here’s how the fraudsters typically go about it, including photographs, excerpts from text exchanges between scammers and targets, advice from training guides for fraudsters and police reports from pig butchering cases:

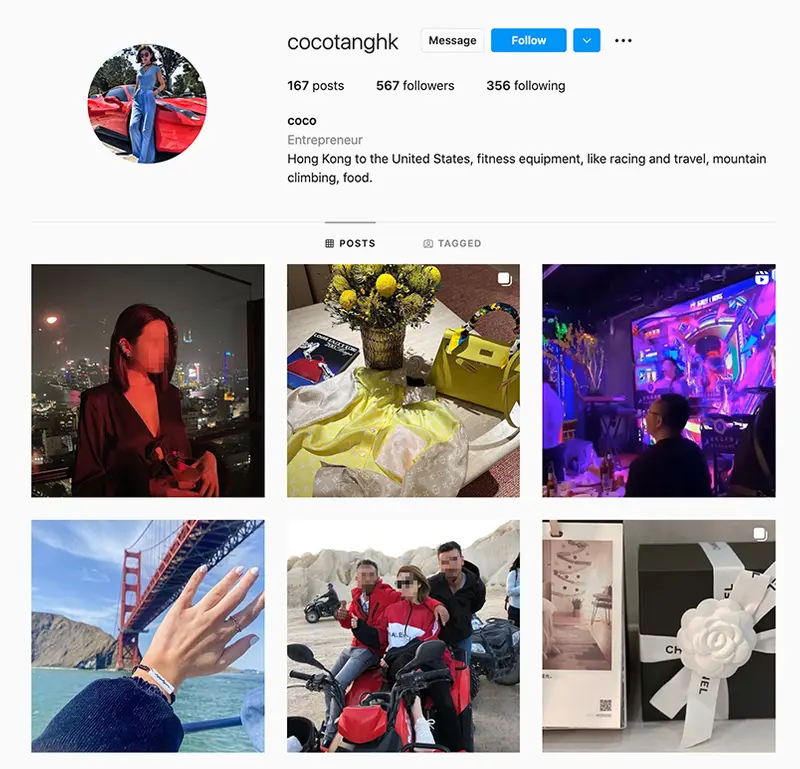

1. Create a fake identityPig butchers most often begin by creating a phony online persona, typically accompanied by an alluring photo (which itself might have been stolen) and images that convey a glamorous lifestyle.

Once they’ve got an online profile, fraudsters begin sending messages to people on dating or social networking sites. Alternatively, they may use WhatsApp or another messaging service and pretend to have stumbled on a “wrong number” as they contact you. (A spokesperson for Meta, which owns WhatsApp, previously told ProPublica that the company is investing “significant resources” into keeping pig-butchering scammers off its platforms.)

In December 2020, a Connecticut man received these messages on WhatsApp from a seemingly friendly stranger. He responded and eventually ended up getting tricked into two scams that cost him a total of $180,000.

3. Win the trust of the targetThe next step is starting a conversation with a potential victim to gain their trust. The scammers often initiate benign chats about life, family and work with an eye toward mining their targets for information about their lives that they can later use to manipulate them. They’ll fabricate details about their own life that make them seem similar to you. After all, people like people who are like them.

When a Houston woman revealed that her brother was born with cerebral palsy, a crook countered with a similar-sounding tale:

4. Sign them upBefore long, the swindlers will pivot to a discussion of investing. They’ll make claims about their own purported investing successes, perhaps sharing screenshots of a brokerage account with gaudy numbers in it. They’ll try to convince targets to open an account at their online brokerage. Unbeknownst to the target, the brokerage is a sham, and any money deposited will go straight to the scammer. Most victims don’t figure out that last part until it’s too late.

Guides for scammers recommend touting the reliability of MetaTrader, a trading app that fraudsters use for nefarious purposes, by pointing out that the app is available in Apple’s App Store, so it must be safe. (MetaTrader did not respond to requests for comment. An Apple spokesperson said the company has shared complaints with MetaTrader’s parent company, and asserted that the parent has taken steps to respond to the complaints.)

5. Get them to put real money into the fake accountOnce marks agree to learn investing tricks, the scammers will “help” them with the investment process. The fraudsters will explain how to wire money from their bank account to a crypto wallet and eventually to the fake brokerage. Typically the fraudster will ease the process by recommending a modest initial investment — which will inevitably show a gain.

A woman in Michigan became intrigued by her online boyfriend’s references to making money trading gold and offered to become his student. Two days later, he was teaching her how to get started investing in a fake brokerage accessible through MetaTrader:

6. “Prove” that it’s legitimateScammers often allay initial doubts by letting targets withdraw money once or twice to convince them the process is trustworthy. For example, fraudsters allowed a Canadian man named Sajid Ikram to withdraw 33,000 Canadian dollars, according to a statement he filed with the Royal Canadian Mounted Police. That returned money helped convince him that his investment was real. He reported ultimately losing nearly $400,000, including money borrowed from several friends.

7. Manipulate them into investing moreThat’s only the beginning. Pig butchering guides offer insights on how to exploit marks’ emotional and financial vulnerabilities to manipulate them into depositing more and more funds. It starts with assurances that the investments are risk-free, then escalates into pressure to take out loans, liquidate retirement savings, even mortgage a house.

Over a period of nine days, one scammer (who called herself Jessica) escalated her pressure, pushing the target, a California man, first to use his cash on hand, then to tap his retirement savings, then to borrow money.

8. Cut them offOnce targets reach a limit and become unwilling to deposit more funds, their seeming investment success comes to a sudden stop. Withdrawals become impossible, or they suffer a big “loss” that wipes out their entire investment.

The California man was aghast when he discovered $440,000 he’d deposited was gone. Ultimately, the swindler persuaded him to invest another $600,000, which also disappeared into the swindler’s account.

9. Use their desperation to your advantageScammers will then turn the screws of manipulation tighter by telling victims there’s a potential solution: If they deposit more cash into the brokerage, they can regain what they lost. Sometimes, the claim is that the investment is successful — but there’s a “tax problem” that requires paying additional funds equal to, say, 20% of their total account value. If the victim pays, the scammer will claim that new obstacles have arisen that require paying new fees.

No matter how much targets pay, it’s never enough, as detailed in the FTC complaint excerpted below, which was filed by a pig butchering victim in Maryland. This person lost almost $1.4 million, in part because the person kept meeting scammers’ demands to pay taxes and various fees to get their money back:

“Once the trading has ended, I applied to withdrawal my money and profit from the website. The broker asked me to pay a tax on the profit of 88,587.90 usd on 8162021, this amount was wired again through Bank of America into a foreign account in Hong Kong. Another request for me to pay security deposit on my profits which was 83,950.00 usd wired out to a different foreign account in Hong Kong once again. The broker asked for a bank and withdrawal processing fee of 27,983.34 usd again was wired out to a different foreign account in Hong Kong. The very last wire was for expediting the withdrawal and the platform asked for 55,966.60 usd wired out to Hong Kong. At this point I already had to much money in the platform so I kept giving in.”

10. Taunt and departOnce the targets are aware that they’ve been swindled, the fraudsters often insult or taunt them. They soon go silent, and the websites of their phony brokerages stop working. Then they relaunch a new website under a different URL and restart the process with other targets.

After nearly four months of chatting and $30,000 in losses for the Michigan victim, her scammer seemed to revel in unveiling the financial — and emotional — deception:

What to Do If You’ve Been ScammedIf you’ve been victimized, report the crime to your bank and law enforcement — the FBI, the Secret Service and local police — as quickly as possible. The longer you wait, the harder it is for your bank to reverse any fraudulent transactions and for law enforcement to trace, freeze or seize stolen funds. “We are definitely going to be more successful if you immediately report,” said Erin West, deputy district attorney at the Santa Clara County District Attorney’s office, which has had some success seizing assets linked to pig butchering scams.

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.