The Seed Slump

I have written a bit about this topic in recent years, at the end of 2017, and again when the 2018 numbers started showing up.

What has happened over the last five years in venture capital is the seed boom stalled out, the late stage market exploded, and the traditional venture capital business (Series A and Series B) largely remained the same except round sizes, valuations, and fund sizes have all gone up.

Mark Suster posted a great analysis last night of why the seed stage market has stalled out. It comes down to the fact that the traditional venture capital market has not changed much so creating more supply has not resulted in materially more demand.

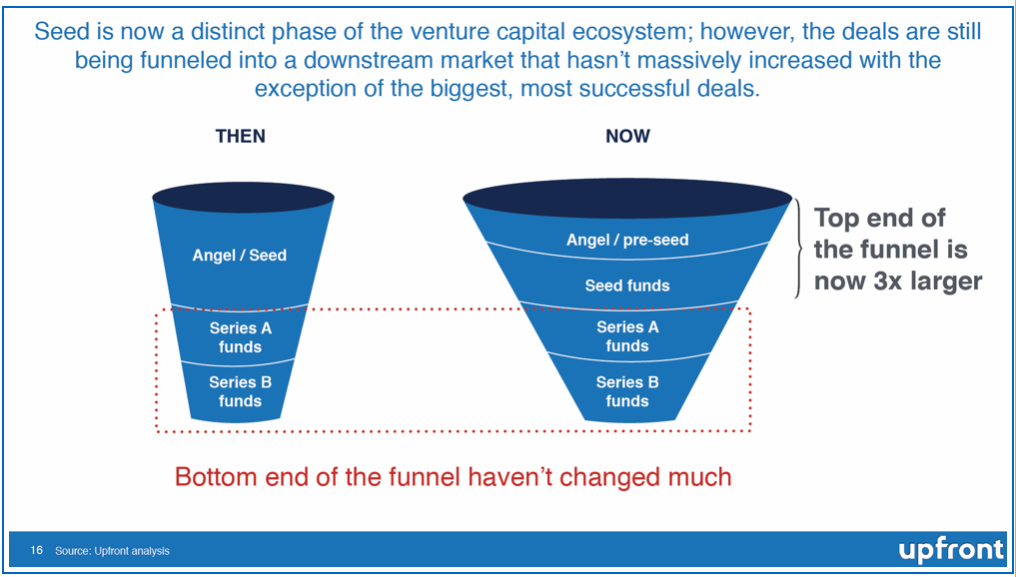

This chart tells the story well:

As Mark explains, the seed market remains alive and well, but it has grown so large that it can’t continue to grow unless the traditional venture capital market grows too and that has not happened, at least not anywhere near the rate that the seed stage market has grown.

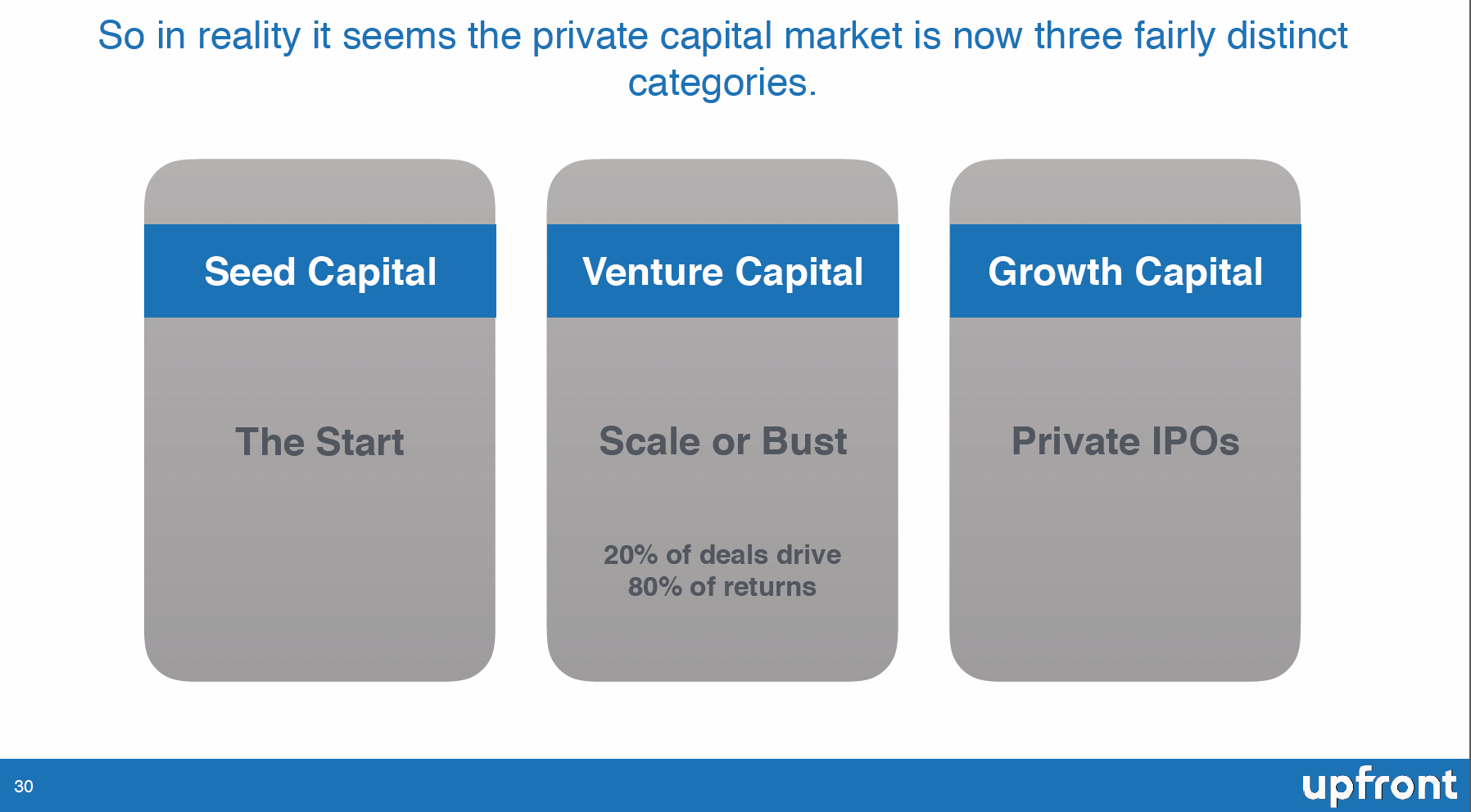

In a companion post, Mark lays out the new architecture of the startup capital markets:

In the first five years of this decade, we saw the seed portion of the market explode. In the last five years of this decade we saw the growth portion of the market explode. But over those last ten years, the middle part, the traditional venture capital market, has not changed much.

That’s an interesting observation in and of itself and something that makes me wonder if that is the next shoe to fall.