The Rich Get Richer

The 2014 numbers for the VC category are out and it was a huge year, almost $50bn in total VC funding.

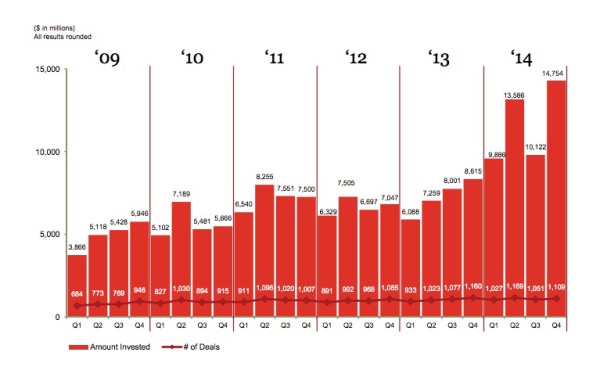

But look at the numbers for “deals” vs the numbers for “dollars”.

In 2014, there were 4,356 deals vs 4,193 deals in 2013, an increase of 3.8% year over year.

In 2014, VCs invested $48.3bn, compared to $29.9bn in 2013, an increase of 61.5%.

Basically, the average deal size went from $7mm in 2013 to $11mm in 2014. But averages don’t really tell the whole story.

What is going on is that the late stage market is going crazy. There was a $100mm+ deal on average every month in 2014 and the late stage market made up 1/3 of all deals.

VCs are all about what is happening now and are not focusing as much on what will happen in five to ten years (the seed/early stage markets).

None of this should be news to those who are paying close attention. Round sizes have gone up and burn rates have gone up, but so much of this is limited to a hundred or a couple hundred companies. The rest of the market is more or less where it has been for years. The rich are getting richer. The middle class is stagnant. And the people who can’t raise a round still can’t. Only the top end of the market has really changed over the past five years.

Kind of like the entire economy, isn’t it?