The Power Of Diversification

I have written about this topic before but it's important and I want to say it again.

Investing in startups is risky. If you make just one investment, you are likely going to lose everything. If you make two, you are still likely to lose money. If you make five, you might get all your money back across all five investments. If you make ten, you might start making money on the aggregate set of investments.

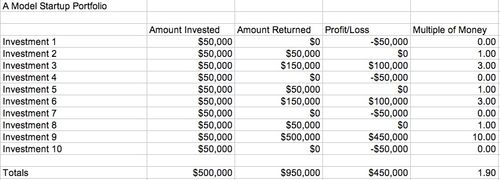

The math behind this is pretty simple. If you assume that the average startup has a 33% chance of making money for the investors, a 33% chance of returning capital, and a 33% chance of losing everything and that only 10% will make a big return (>10x), then you can model this out.

All the profit in that ten investment portfolio comes from the big winner. If you don't make that investment, you would have made nine investments for a total of $450,000 and you would have gotten back $450,000. You would have been better keeping the money in the bank.

So you need to make enough investments to be confident that you will get at least one big winner. And so that means making enough bets.

There's another important aspect of this. You should invest roughly the same amount in every investment. Don't try to pick the winners at the time of investment by putting more in the ones that are "sure things" and less in the ones you are less sure about. The only sure thing about startup investing is that there are no "sure things."

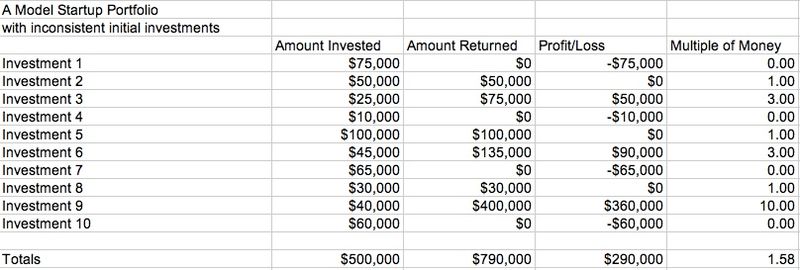

Let's look at the same portfolio with a set of random initial investment amounts.

You can see that even with the same set of outcomes for each investment, the amount invested in each one has a big impact on the total return of the portfolio. It really all comes down to how much you have invested in your big winner. And since I do not believe you can predict which one will be your big winner, my view is you want to be as consistent as possible with your investment amounts.

When you are an investor, there are days when some of your investments are doing great and some are doing badly. If you are broadly diversified, those days are easier to take. If you are all in on one investment, then those days are brutal. Entrepreneurs go all in and are rewarded accordingly when they hit it. Investors should not go all in. They should be diversified.