The Hit Rate

This simple and short blog post by the folks at Correlation Ventures contains the key to venture capital returns – the hit rate.

In the Correlation post, they define “hit rate” as:

the percent of invested dollars generating a 10X or greater return

But “hit rate” could be something else. It could be the number of investments in your portfolio that return the fund. It could be the number of seed investments you make that turn into billion-dollar valued businesses. It could be the number of your seed and Series A investments that go public.

My point is that it doesn’t really matter than much how you define hit rate.

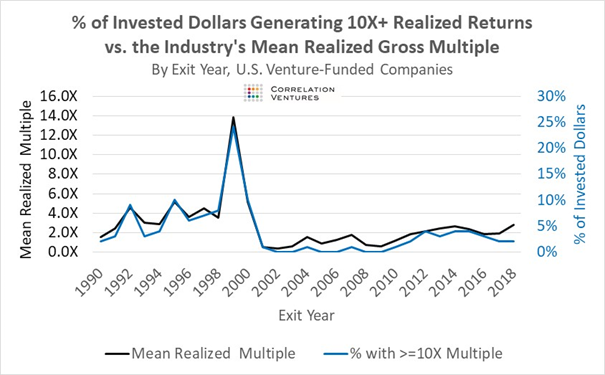

What is important is this chart from the Correlation post:

I guess they have a keen eye for correlation at Correlation Ventures. They certainly found it here.

Venture capital returns are highly correlated to a fund’s hit rate.

Or said differently, a fund’s hit rate determines their returns.

I think that is a pretty well-known fact these days with all of the obsession with billion-dollar valued companies, or “whales” as I like to call them.

We know that venture investments result in a power-law distribution of outcomes.

And so one or two companies will determine the returns in a given fund.

Sometimes that is not the case. In our 2004 fund it was five companies, but that is why that fund was so good.

The other interesting thing about that chart is why the hit rates and returns in the venture capital industry have not returned to pre-2000 levels.

I think that is all about the amount of capital in the business now. More capital means more businesses get funded. So even if you have more winners, you don’t see the hit rates move up. The numerator and the denominator have both grown in the hit rate calculations.

Before 2000, the venture capital business was a bit of a cottage industry.

In the last 15 years, VC has become an institutional asset class with the permanence and stature that brings seemingly endless amounts of capital to it.

And so the returns have stabilized in or around the 2-2.5x over ten years number, which produces high teens/low 20s IRRs, which is enough to sustain the sector.

The only thing that I think would take us back to mean multiples of 4x or better would be some sort of massive reduction in the amount of capital coming into the venture capital business. And I don’t see that happening any time soon.

But one thing about the VC business has not changed in all of the years in that chart, which is roughly how long I have been a partner in a venture firm, and that is that your big winners will determine your returns.

Same as it always was.

.jpg)

.jpg)

.jpg)