The Chinese Treasury Dump Boogie Man

In discussions around the issue of the US – China economic relationship much has been said about the threat of the Chinese dumping their extensive portfolio of US Treasuries (bonds, bills, notes). Is it a real threat?

You decide.

Give me the facts, just the facts, Big Red Car

OK, dear reader, here are the nascent facts:

Now give me some bloody analysis, Big Red Car

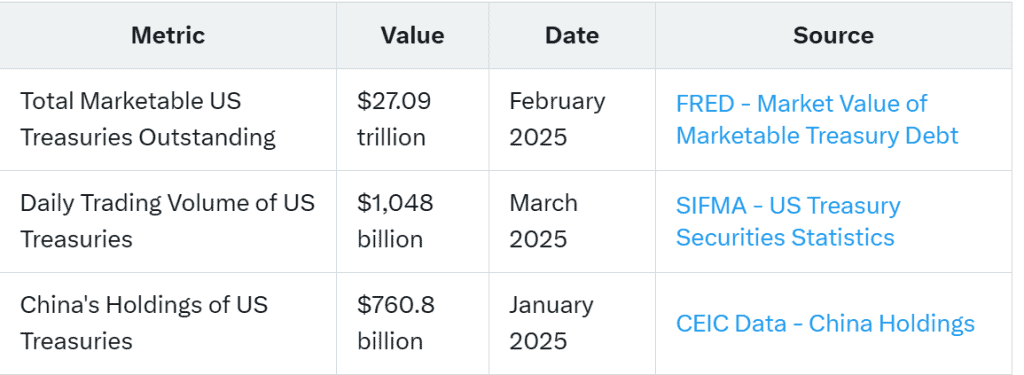

As you can see, the US has marketable UST outstanding of $27.09T — trillion.

China holds $761B — billion of those UST. This is 2.8% of UST outstanding. It is substantial from a gross perspective, but very little from a relative perspective.

Daily, more than a trillion dollars of UST change hands — $1.048T — trillion.

Another point is other foreign countries hold $7.9T — trillion — of UST. Therefore, the Chinese hold approximately 10% of the UST held by foreign countries.

Bottom line it, Big Red Car, we’re going ice skating

OK, dear reader, here it is.

1. Yes, the Chinese hold a substantial portfolio of US Treasuries in absolute terms, but in relative terms, they are less than 3% of the global market.

Chinese UST holdings are only 10% of foreign holdings of UST. This surprises me. I thought it would be much more.

2. The daily turnover for US Treasuries is more than the entire holdings of the Chinese. This is not to say that China’s sale of UST could not impact the market, but it will not have a long term or irreversible impact on US Treasury prices.

If the Chinese sold off 5% of their holdings, they would be out within 3 weeks and any impact on pricing would be absorbed and mitigated.

3. If the Chinese sell off their US Treasuries, they will receive US Dollars. WTF will they do with their USD? Buy oil?

One cautionary note — if the Chinese were to attack Taiwan, I would expect them to sell off all their UST holdings BEFORE that attack.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car.