The 0.00% Yield

The Gotham Gal and I don't normally keep much cash in the bank. We like a portfolio of tax free municipal bonds for our cash that is not invested in venture deals, private companies, real estate, and the like.

But recently we closed a few transactions that resulted in some cash being wired into our bank account. I emailed the banker and asked him to move the cash to the brokerage account connected to our checking account and into a tax free money market.

A few days later I was thinking about whether to keep the cash in the tax free money market account or move it to our tax free bond portfolio. So I emailed the banker again and asked what the yield was in the tax free money market account. The answer I got surprised me:

Unfortunately, both the Tax-Free Money Market Sweep and Federal Money Market Fund in your brokerage account are currently yielding 0.00%.

Yup, that is right. 0.00%.

Needless to say the cash won't stay at the bank much longer.

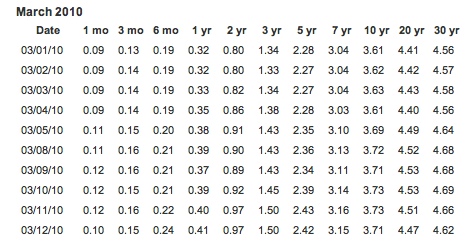

But I didn't leave it at that. I did some digging around. I looked at treasuries. Here are the current treasury yields:

You can see why a federal money market fund yields 0.00%. The treasuries the fund likely owns are yielding 10 to 25 basis points. And I guess that yield is totally gone after their fees are applied.

I've got emails out to a few other banks we do business with to find out what their money markets are paying. I'm curious if the 0.00% money market yield is standard across the market right now.

Regardless of whether or not my bank or any bank is taking advantage of its customers (and I am not sure they are), this zero interest rate environment is worth thinking about.

I was at dinner last night with friends and we got to talking about the stock market. Our friend asked me why I thought the market was doing so well (the S&P 500 is up 65% in the past year, from its post meltdown low). I told him in an environment where cash in the bank yields 0.00% two things happen. First, people chase yields elsewhere and the US stock market has been a big beneficiary of that. Second, you can borrow money at very low cost (not 0.00% though) and put it into the market.

That's why this "hyper low" rate environment is dangerous. Because it won't last and when rates start to go up, the market will stall or even decline. Many of the places people have gone to chase yields will not be great places to be.

So what to do when your bank is paying you 0.00%? Well as I said at the start of this post, we like a portfolio of highly rated (AA and AAA) municipal bonds. In this low rate environment, I like the stub end of a long term muni bond that has a year or two left on it. You pay a premium to its face value to buy it and when it pays off, you will get less than you paid for it. But in the interim you'll get a decent tax free yield and all in, including the loss on the purchase price, over the one or two year hold period you can get 2% to 2.5% tax free. I don't recommend trying to buy these bonds yourself. Find a good manager who has been doing it for years to do this for you.

And then wait for rates to rise. Because I am certain they will. And don't jump in quickly when they do. Because when rates rise, they tend to do that for a while. And of course, the money markets will start to pay interest again.

The take away from this post is that rates are at historical lows. You can't really go below 0.00% without having to pay someone to take your cash from you. It's a dangerous time. Don't chase yields. Find an acceptable place to put your money for a year or two at a low, but positive, yield. And then wait for rates to rise. Because they will and you don't want to be in the wrong place when that happens.