Still Open For Business

I wrote a blog post on March 12th called Open For Business and thought I would return to the topic.

If you search for “vc open for business” on Twitter, you will see almost universal scorn for the idea that VCs are open for business right now.

But our experience doesn’t match that scorn. Since writing that post, we have watched a bunch of our portfolio companies close financings, some on the same terms as provided before the pandemic and some on slightly adjusted terms. We have mostly seen VC firms live up to the commitments they made pre-pandemic and in the cases where terms changed, it has not been not gratuitous.

On our side, we have signed three or four term sheets since I wrote that post, closed on a few of them already, are currently engaged in several processes.

We have had to step up to the plate in a few situations and provide interim financing, and we are certainly working very closely with our existing portfolio companies during this challenging time for many of them. But our focus has not moved dramatically away from looking at and investing in new companies and we don’t see a dramatic change in that regard among many of our peers in the venture community.

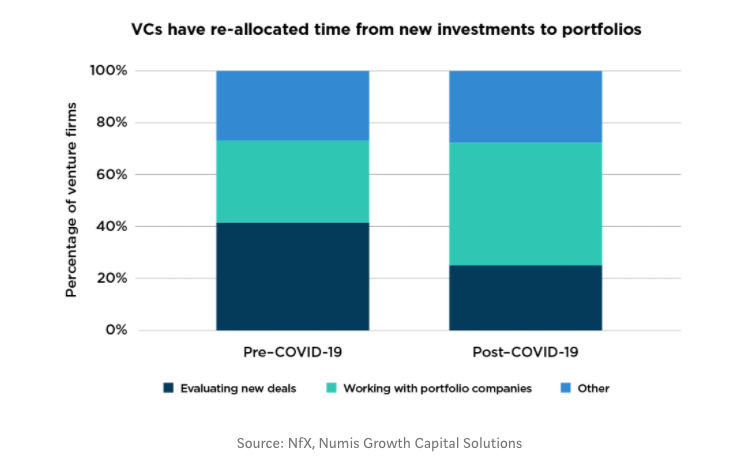

David Kelnar sent me a blog post he wrote addressing some of these trends this morning and I saw this chart in it.

I don’t think new investment activity has shrunk from 40% of the industry’s time to just above 20%. From what I see, it has shrunk a bit, but not cut in half.

There certainly are funds who are focused on sectors that have taken a bath in the pandemic and in those cases it is natural and appropriate for those funds to be more focused on their portfolios. But I don’t see that across the entire VC landscape.

It is always easy to talk yourself into the idea that the door is currently shut for you. But before you do that, I suggest you knock on it. It may in fact be open.