Stash Your Cash

My partner Rebecca announced our most recent investment yesterday in a company called Stash.

Stash is a simple mobile app that you connect to your bank account and each week (or month) you stash some of your cash away (ie save) and the app invests it for you in a portfolio of funds that it puts together for you based on your investing interests.

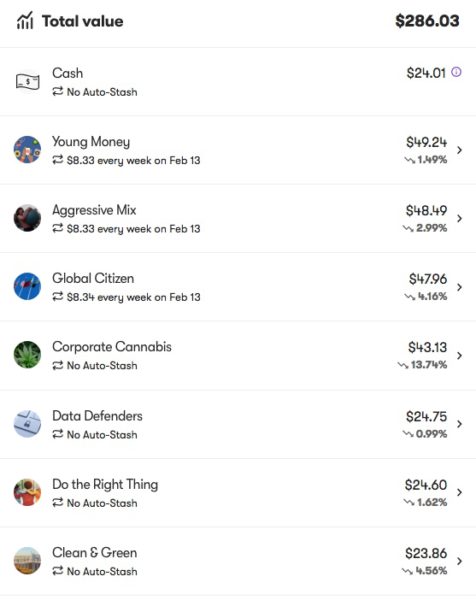

Here is my current Stash portfolio:

As you can see, I “auto stash” $25/week and it gets invested in the first three funds.

I have also directly bought four additional funds. I get mobile notifications on my phone when new funds are offered (like “corporate cannabis”, that was an instant buy).

I can move around where I want my weekly auto-stash funds to get invested. I think I might do that today and direct more funds toward some of these other funds that I quite like.

If you want to get Stash on your phone and start saving and investing, you can do that here: iOS Android

Clearly Stash is not aimed at people like me. We have traditional brokerage accounts and portfolios that we manage there.

Stash is aimed at young adults and people who are having difficulty saving for their future (home, college, retirement, etc).

As Rebecca wrote in her post:

85% of users on Stash come in as either beginners or without any investing experience and now can open their investment account with as little as $5.

That is a great stat. Stash is helping to build a new generation and a new cohort of savers and investors. With the decline of pension plans and other “safety nets”, it is more important than ever that everyone learn to save and invest. And the only way to do it is one day, week, month at at time and using the power of compounding earnings to your advantage.

When we looked closely at our USV portfolio recently, we realized that most of our best investments are all about expanding access to knowledge, capital, and wellbeing. Stash fits directly in that theme by making saving and investing easy and affordable for everyone (in the US for now).