Some Thoughts On Geography

Many people, including some of our investors, think of our firm as New York centric investor. That has never been true. We are focused on one thing, internet services of scale, and are willing to travel to find them.

But you can only spend so much time on an airplane unless you are Dave McClure or Joi Ito. And I am not in their league when it comes to air travel.

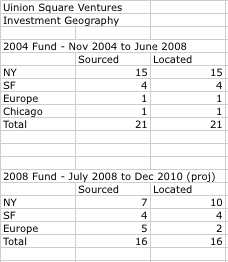

So I thought I'd show some data this morning. I went back over all of our investments since we started in 2004. And I added three term sheets we have signed but have not yet closed on (yes, we've been busy).

Here is the data:

What you see is that we have never been focused exclusively on NYC but over time we have started to stretch our wings. And our "wings" go in two places, SF and Europe. Basically, we fly the NYC-SF and NYC-London routes.

Europe is particularly interesting. We have sourced investments in London, Berlin, Holland, Israel, and Slovenia. I know that Israel is not technically in Europe but I put it there anyway. Of the six investments we have sourced in Europe, three are now headquarted in NYC and one other has significant operations in NYC. We like finding great teams in Europe and helping them set up the headquarters in NYC. I expect we will do more of that as well as more investments headquartered in Europe.

We will have eight SF based investments by year end assuming everything closes. That is roughly 22% of our portfolio by names. I suspect we will continue to do between 20% and 30% of our investments in SF for as far forward as I can see.

NYC is our home and where we do the majority of our investments. That is how it should be because we are primarily early stage investors and it is best to be close to our companies. We have 25 companies headquarteed in NYC, including two who have exited. I think that is one of the largest portfolios of venture stage (not angel stage) companies in NYC. Maybe the largest. We are proud of that fact and plan to keep adding to it as long as we see opportunity. And we see a lot in NYC right now.

This post might leave the impression that we won't go anywhere other than NY, SF, or Europe to look for investments. That is not true. We have companies with operations in Boulder and Austin and go there regularly. We see opportunity in Seattle, LA, Boston, DC, Chicago, Toronto, and elsewhere. But it is also true that once you start going someplace regularly, start working with the local investors and the local entrepreneurs, you tend to focus your energies there. We'd like to add a few more geographies to our routines so keep the opportunities outside of our big three locations coming. As I said in the start of this post, we are focused on internet services of scale and will travel to find them.