Some Things To Be Thankful For This Year

1) The economic meltdown/panic of 2008 is largely over. The economy is still weak but markets are functioning and buyers are buying and sellers are selling.

2) The FCC has submitted a proposal for rulemaking on net neutrality.

3) Android looks to be a winner and will give the iPhone a much needed competitor to keep Apple honest.

4) Bing is showing some signs of life and may give Google a much needed competitor to keep them honest (this one may be wishful thinking).

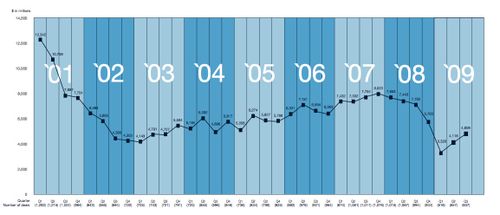

5) Venture Capital investing is bouncing back:

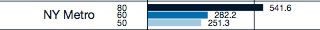

6) The NY Metro venture investing market is bouncing back even more sharply:

7) Programs like Y Combinator, Techstars, Seedcamp, etc are expanding all over the country and now the world, turning out newly minted entrepreneurs by the thousands.

8) A secondary market for founder stock, employee stock, and angel and early stage investor’s shares is emerging, offering the possibility of a third way to get liquid on startup investments.

9) The NASDAQ’s Internet Index is up 128% over the past year suggesting that wall street loves the internet sector again. Can a vibrant Internet IPO market be far away?

10) It’s thanksgiving day, a day to forget all of this stuff and spend it cooking, eating, watching football, and hanging with good friends and family. That’s what I plan to do and I hope all of you do too.

Note: The charts on venture investing in this post come from the PWC Money Tree survey for Q3 2009.