Shared ownership could be an option for first-time buyers. We interviewed 4 different types who have chosen this route.

Is it really possible?!

September 26th 2024.

Have you heard about people buying their first home through shared ownership or are you considering it? If so, let me introduce you to some individuals who have successfully done so.

For many first-time buyers, the past few years have been challenging. Rising rent prices, expensive house prices, and stricter lending criteria have caused many to put their plans on hold. According to Mortgage Advice Bureau, 36% of first-time buyers will now purchase a home later than they had originally planned due to these obstacles. Additionally, the same percentage have stated that the increase in rent prices has made it difficult for them to save for the required deposit.

One of the biggest hurdles for first-time buyers is saving for the initial down payment. In fact, Zoopla reports that those who receive financial assistance from their families are able to buy a home six years earlier than those who do not. However, there is a glimmer of hope for those who do not have help from the "Bank of Mum and Dad": shared ownership.

But what exactly is shared ownership? It is a flexible scheme that allows you to purchase a share in a home while paying rent on the remaining balance. This initial share can range from 10 to 75 percent of the home's full market value and is financed through a deposit and mortgage. With a deposit as low as five or ten percent of the portion you are buying, it is much more affordable compared to buying on the open market.

To be eligible for shared ownership, applicants must have a good credit score and a household income that does not exceed £90,000. They must also be unable to afford the deposit and mortgage payments on a home that meets their needs on the open market. This scheme is not just limited to first-time buyers; existing shared owners looking to move and former homeowners wanting to get back on the property ladder can also apply. Shared ownership could be the perfect option for solo buyers, couples, and families alike.

In fact, Shared Ownership Week, an annual event that promotes this affordable homebuying scheme, is currently underway and will run until October 1st. So, let's hear from some real people who have bought a home through shared ownership.

Solo Buyer

Meet Srekanth Nilakantan, a 27-year-old from India who spent several years studying and working in Dublin before moving to London for a new job as a digital marketing manager. After renting in Hounslow, Srekanth's goal was to find a place of his own as soon as possible. He wanted a home in a convenient location, with outdoor space, nearby greenery, and enough room to host his family and friends.

After getting to know the area, Srekanth was determined to put down roots in Hounslow. However, he couldn't find a home that he liked and could afford until a friend recommended shared ownership at NHG Homes' Lampton Parkside. With a park next door, a nearby Tube station, and a spacious layout, it was the perfect fit for Srekanth. In February of last year, he bought a 25 percent share of a two-bedroom flat with a balcony for £107,500, using a £25,000 deposit. His combined monthly payments for the mortgage, rent, and service charge come to £1,303.

Srekanth is grateful for the security that comes with owning his own home. He explains, "In Dublin, I couldn't have my family stay with me because I was renting with my friends. And when I moved to London, it was the same situation all over again. But thanks to shared ownership, I was able to buy my own home and have my family visit me in London sooner than I ever thought possible. Plus, with my new job, it was important for me to have a convenient commute. Hounslow Central Tube station is just a five-minute walk away, and I can easily catch the Piccadilly line to Holborn."

The Solo Buyer cont'd

If you're interested in a shared ownership home, one- and two-bedroom options at Lampton Parkside start at £83,125 for a 25 percent share of £332,500 through NHG Homes.

The Couple

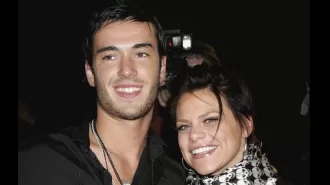

Next, let's meet Louis and Chloe Rice, a couple from Milton Keynes, aged 25 and 27, who were planning for their future and expecting a baby. With their families, friends, and jobs all in the area, they were determined to stay local when buying their first home. Initially, they looked at older properties, but when Chloe's brother bought a shared ownership home at Places For People's Laconia Place, they became interested in the new shared ownership homes that were being built there.

They found a two-bedroom house at the development that was even bigger than their rental home and had a garden for their cat to enjoy. They realized it ticked all their boxes, and in February, they moved into their new home after purchasing a 40 percent share off-plan. Now, they are happily settled and are looking forward to decorating the nursery and planting vegetables in their garden.

Chloe shares her thoughts on the whole process, "We had heard about shared ownership and knew it was an option, but seeing my brother's experience and how happy he was with his home made us seriously consider it. We're so glad we did because we now have a place of our own, and we can plan for our future as a family. We're really happy with our decision to go for shared ownership."

So, whether you've heard about shared ownership or are just now considering it, there are many success stories from people of all backgrounds who have found their dream home through this scheme. Don't let the current housing market hold you back from achieving your goal of homeownership. Explore shared ownership and see if it's the right fit for you.

Have you heard about shared ownership or are you considering it? If so, you should definitely hear from those who have already bought their first home through this affordable scheme.

Being a first-time buyer in recent years has been challenging, with high rent, house prices, mortgage rates, and the cost of living making it difficult to save for a deposit. According to Mortgage Advice Bureau, many have had to delay their plans to buy a home due to these obstacles. In fact, 36% of first-time buyers have pushed back their purchase timeline, and the same percentage have been affected by increasing rent prices, making it harder to save for a deposit.

The biggest hurdle for first-time buyers is finding the necessary down payment, and those who receive financial assistance from their families are able to buy a home six years earlier than those who don't. However, with the declining mortgage rates, there is still hope for those without help from the Bank of Mum and Dad - shared ownership.

But what exactly is shared ownership? It's a flexible scheme that allows you to buy a share in a home while paying rent on the remaining portion. The initial share can range from 10% to 75% of the home's full market value, and is financed by a deposit and mortgage. The deposit, which is only 5-10% of the share you're buying, is much more manageable than the down payment required on the open market, making it easier to save up for.

To be eligible for shared ownership, applicants must have a good credit history and a household income of no more than £90,000. They must also be unable to afford the deposit and mortgage payments for a home that meets their needs on the open market. This scheme is not only available to first-time buyers, but also to existing shared owners looking to move and former homeowners hoping to get back on the property ladder.

Shared ownership week, an annual event that celebrates this affordable homebuying scheme, is currently underway and will run until October 1st. So, whether you're a solo buyer, a couple, or a family, shared ownership could be the perfect solution for you. Now, let's hear from some real people who have successfully bought a home through shared ownership.

Srekanth Nilakantan, a 27-year-old from India, had been living in Hounslow, London for some time, but was still renting and eager to have a place of his own. He wanted a home in a convenient location with outdoor space, greenery nearby, and enough room to host his family and friends. After getting to know the area, he discovered shared ownership at NHG Homes' Lampton Parkside, which was recommended to him by a friend. With its close proximity to a park and a tube station and a spacious layout, it was exactly what he was looking for. In February of last year, he bought a 25% share of a two-bedroom flat with a balcony for £107,500, putting down a deposit of £25,000. His monthly payments for mortgage, rent, and service charges add up to £1,303. Srekanth loves the security and stability that comes with owning his own home, and is grateful for the opportunity shared ownership has given him to have his family visit him in London.

Chloe and Louis Rice, a couple aged 25 and 27, were also looking for their first home in Milton Keynes. With their families, friends, and jobs all in the area, they wanted to stay local and were also expecting a baby. After initially considering older properties, they came across the new shared ownership homes at Places For People's Laconia Place, as Chloe's brother had recently bought one there. When they found a two-bedroom house with a garden for their cat, they knew it was the perfect fit. They bought a 40% share off-plan and have been happily living there since February. They are now planning to decorate the nursery and plant some vegetables in their new home.

Shared ownership has made the dream of owning a home a reality for many people from all walks of life. With its flexibility and affordability, it is a great option for those struggling to save for a deposit on the open market. So, if you're considering buying your first home, be sure to look into shared ownership and see if it could be the right path for you.

For many first-time buyers, the past few years have been challenging. Rising rent prices, expensive house prices, and stricter lending criteria have caused many to put their plans on hold. According to Mortgage Advice Bureau, 36% of first-time buyers will now purchase a home later than they had originally planned due to these obstacles. Additionally, the same percentage have stated that the increase in rent prices has made it difficult for them to save for the required deposit.

One of the biggest hurdles for first-time buyers is saving for the initial down payment. In fact, Zoopla reports that those who receive financial assistance from their families are able to buy a home six years earlier than those who do not. However, there is a glimmer of hope for those who do not have help from the "Bank of Mum and Dad": shared ownership.

But what exactly is shared ownership? It is a flexible scheme that allows you to purchase a share in a home while paying rent on the remaining balance. This initial share can range from 10 to 75 percent of the home's full market value and is financed through a deposit and mortgage. With a deposit as low as five or ten percent of the portion you are buying, it is much more affordable compared to buying on the open market.

To be eligible for shared ownership, applicants must have a good credit score and a household income that does not exceed £90,000. They must also be unable to afford the deposit and mortgage payments on a home that meets their needs on the open market. This scheme is not just limited to first-time buyers; existing shared owners looking to move and former homeowners wanting to get back on the property ladder can also apply. Shared ownership could be the perfect option for solo buyers, couples, and families alike.

In fact, Shared Ownership Week, an annual event that promotes this affordable homebuying scheme, is currently underway and will run until October 1st. So, let's hear from some real people who have bought a home through shared ownership.

Solo Buyer

Meet Srekanth Nilakantan, a 27-year-old from India who spent several years studying and working in Dublin before moving to London for a new job as a digital marketing manager. After renting in Hounslow, Srekanth's goal was to find a place of his own as soon as possible. He wanted a home in a convenient location, with outdoor space, nearby greenery, and enough room to host his family and friends.

After getting to know the area, Srekanth was determined to put down roots in Hounslow. However, he couldn't find a home that he liked and could afford until a friend recommended shared ownership at NHG Homes' Lampton Parkside. With a park next door, a nearby Tube station, and a spacious layout, it was the perfect fit for Srekanth. In February of last year, he bought a 25 percent share of a two-bedroom flat with a balcony for £107,500, using a £25,000 deposit. His combined monthly payments for the mortgage, rent, and service charge come to £1,303.

Srekanth is grateful for the security that comes with owning his own home. He explains, "In Dublin, I couldn't have my family stay with me because I was renting with my friends. And when I moved to London, it was the same situation all over again. But thanks to shared ownership, I was able to buy my own home and have my family visit me in London sooner than I ever thought possible. Plus, with my new job, it was important for me to have a convenient commute. Hounslow Central Tube station is just a five-minute walk away, and I can easily catch the Piccadilly line to Holborn."

The Solo Buyer cont'd

If you're interested in a shared ownership home, one- and two-bedroom options at Lampton Parkside start at £83,125 for a 25 percent share of £332,500 through NHG Homes.

The Couple

Next, let's meet Louis and Chloe Rice, a couple from Milton Keynes, aged 25 and 27, who were planning for their future and expecting a baby. With their families, friends, and jobs all in the area, they were determined to stay local when buying their first home. Initially, they looked at older properties, but when Chloe's brother bought a shared ownership home at Places For People's Laconia Place, they became interested in the new shared ownership homes that were being built there.

They found a two-bedroom house at the development that was even bigger than their rental home and had a garden for their cat to enjoy. They realized it ticked all their boxes, and in February, they moved into their new home after purchasing a 40 percent share off-plan. Now, they are happily settled and are looking forward to decorating the nursery and planting vegetables in their garden.

Chloe shares her thoughts on the whole process, "We had heard about shared ownership and knew it was an option, but seeing my brother's experience and how happy he was with his home made us seriously consider it. We're so glad we did because we now have a place of our own, and we can plan for our future as a family. We're really happy with our decision to go for shared ownership."

So, whether you've heard about shared ownership or are just now considering it, there are many success stories from people of all backgrounds who have found their dream home through this scheme. Don't let the current housing market hold you back from achieving your goal of homeownership. Explore shared ownership and see if it's the right fit for you.

Have you heard about shared ownership or are you considering it? If so, you should definitely hear from those who have already bought their first home through this affordable scheme.

Being a first-time buyer in recent years has been challenging, with high rent, house prices, mortgage rates, and the cost of living making it difficult to save for a deposit. According to Mortgage Advice Bureau, many have had to delay their plans to buy a home due to these obstacles. In fact, 36% of first-time buyers have pushed back their purchase timeline, and the same percentage have been affected by increasing rent prices, making it harder to save for a deposit.

The biggest hurdle for first-time buyers is finding the necessary down payment, and those who receive financial assistance from their families are able to buy a home six years earlier than those who don't. However, with the declining mortgage rates, there is still hope for those without help from the Bank of Mum and Dad - shared ownership.

But what exactly is shared ownership? It's a flexible scheme that allows you to buy a share in a home while paying rent on the remaining portion. The initial share can range from 10% to 75% of the home's full market value, and is financed by a deposit and mortgage. The deposit, which is only 5-10% of the share you're buying, is much more manageable than the down payment required on the open market, making it easier to save up for.

To be eligible for shared ownership, applicants must have a good credit history and a household income of no more than £90,000. They must also be unable to afford the deposit and mortgage payments for a home that meets their needs on the open market. This scheme is not only available to first-time buyers, but also to existing shared owners looking to move and former homeowners hoping to get back on the property ladder.

Shared ownership week, an annual event that celebrates this affordable homebuying scheme, is currently underway and will run until October 1st. So, whether you're a solo buyer, a couple, or a family, shared ownership could be the perfect solution for you. Now, let's hear from some real people who have successfully bought a home through shared ownership.

Srekanth Nilakantan, a 27-year-old from India, had been living in Hounslow, London for some time, but was still renting and eager to have a place of his own. He wanted a home in a convenient location with outdoor space, greenery nearby, and enough room to host his family and friends. After getting to know the area, he discovered shared ownership at NHG Homes' Lampton Parkside, which was recommended to him by a friend. With its close proximity to a park and a tube station and a spacious layout, it was exactly what he was looking for. In February of last year, he bought a 25% share of a two-bedroom flat with a balcony for £107,500, putting down a deposit of £25,000. His monthly payments for mortgage, rent, and service charges add up to £1,303. Srekanth loves the security and stability that comes with owning his own home, and is grateful for the opportunity shared ownership has given him to have his family visit him in London.

Chloe and Louis Rice, a couple aged 25 and 27, were also looking for their first home in Milton Keynes. With their families, friends, and jobs all in the area, they wanted to stay local and were also expecting a baby. After initially considering older properties, they came across the new shared ownership homes at Places For People's Laconia Place, as Chloe's brother had recently bought one there. When they found a two-bedroom house with a garden for their cat, they knew it was the perfect fit. They bought a 40% share off-plan and have been happily living there since February. They are now planning to decorate the nursery and plant some vegetables in their new home.

Shared ownership has made the dream of owning a home a reality for many people from all walks of life. With its flexibility and affordability, it is a great option for those struggling to save for a deposit on the open market. So, if you're considering buying your first home, be sure to look into shared ownership and see if it could be the right path for you.

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment