Seed Rounds At $100mm Post Money

We have been seeing quite a few seed rounds getting done in and around $100mm post-money and that concerns me for a few reasons:

- Seed stage is when a company has a good team, a good idea, but has not yet proven product market fit and a go to market model, and has not yet demonstrated a sustainable business model.

- These investments have a high failure rate. In my experience, roughly half of seed stage investments fail completely, wiping out everyone’s investment, including the founding team’s.

- There is a lot of dilution from the seed round to exit, in my experience, a seed investor will be diluted by around 2/3 between seed and exit.

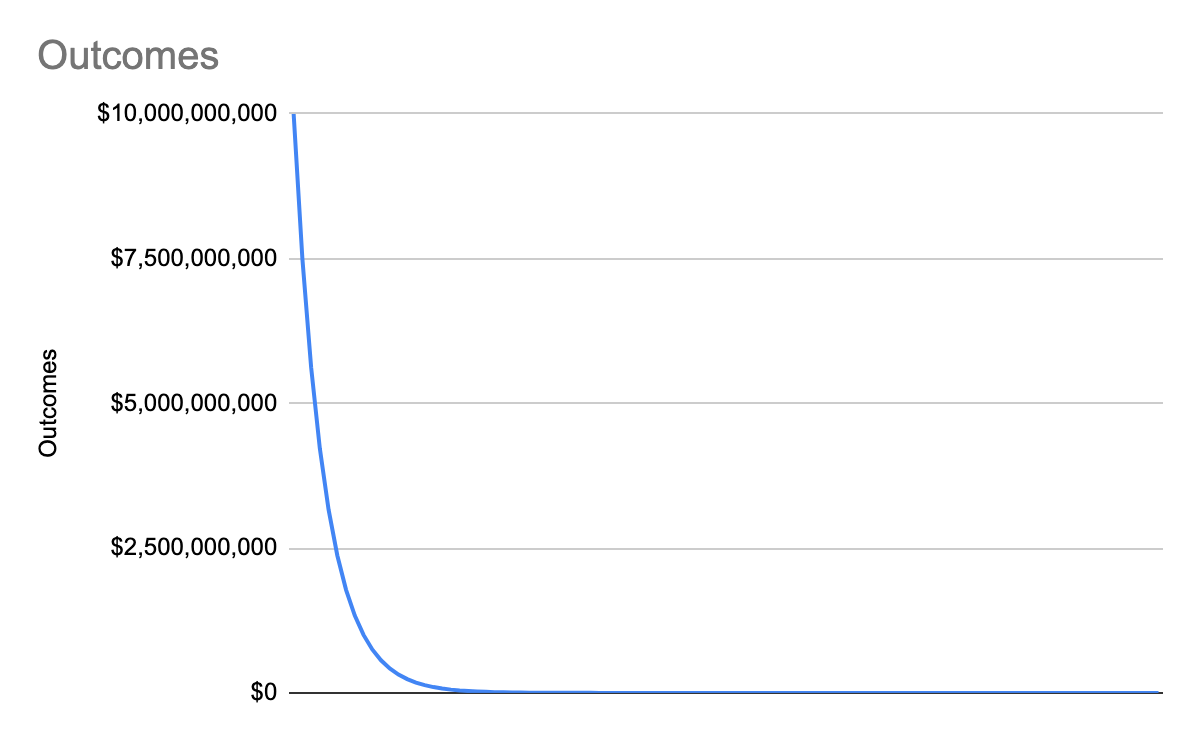

- A power law distribution exists in outcomes in any early stage portfolio and a seed portfolio is no differernt.

So given that I am jet-lagged and got up at 3:30 am this morning, I modeled this out to see how this all works. Here is the google sheet in case you want to look at my model.

Here are the assumptions:

| Assumptions: | |

| Fund Size | $100,000,000 |

| Number Of Investments | 100 |

| Post-Money Value | $100,000,000 |

| Investment Amount | $1,000,000 |

| Ownership | 1.00% |

| Average Dilution from Seed to Exit | 66.67% |

| Top-Performing Investment Outcome | $10,000,000,000 |

| Power Law Number | 0.75 |

Power Law Distribution Of Outcomes:

Given those assumptions, a $100mm seed fund that makes all of its investments at $100mm post-money will barely return the fund. And that number is gross, before fees and carry.

| Total Value At Exit | $133,333,323 | ||

| Fund Return | 1.33 |

Now all of this depends on a few important assumptions.

If you believe your top-performing investment, out of 100 investments, will end up being worth $100 billion, then the numbers change a lot. You end up with a 13x fund instead of a 1.3x fund, before fees and carry.

The dilution from seed to exit also matters a lot. If you believe the dilution from seed to exit is only 50% and your top-performing investment, out of 100 investments, will be worth $10 billion, then you will end up with a 2x fund, before fees and carry, instead of a 1.3x fund (at 2/3 dilution).

There are only several hundred companies in the world with market caps of over $100 billion and roughly a quarter of them have come out of venture capital portfolios in the last thirty years.

So it can happen, but it is very unlikely. In almost twenty years of producing some of the highest performing VC funds in the business, USV has never had a portfolio company become worth over $100 billion. That is a very high bar, too high to expect in your portfolio.

So, in a world where we are seeing more and more $100mm valued seed rounds, one has to ask the question what are the investors expecting? A $100 billion outcome? Doubtful. Less dilution, maybe. A different power-law distribution? Don’t count on it.

I think they are being delusional, comforted by the likelihood that someone will come along and pay a higher price in the next round. But it seems that person may also be delusional. Because when you model things out, the numbers just don’t add up.

I think a strong case can be made for seeds in the low eight figures. If you run that same model with a $20mm post-money value, you get a 6.667x fund before fees and carry. That’s a strong seed fund, probably a tad better than 4x to the LPs, after fees and carry. If you think you can get one of your hundred seed investments to a $10bn outcome, then paying $20mm post-money in seed rounds seems to make a lot of sense.

The exit values in VC have increased significantly over the last decade leading to escalating entry values. That makes sense. But the two things that have not changed materially over the last decade are the dilution from seed to exit and the power-law distribution of outcomes in an early stage portfolio.

The failure rates are so high in early-stage investing that the power-law curves are steep. If your best-performing investment, after taking significant dilution, cannot return your early-stage fund, then you are doing something wrong.

Update: I saw this tweet just now and thought that it makes a great addition to this post: