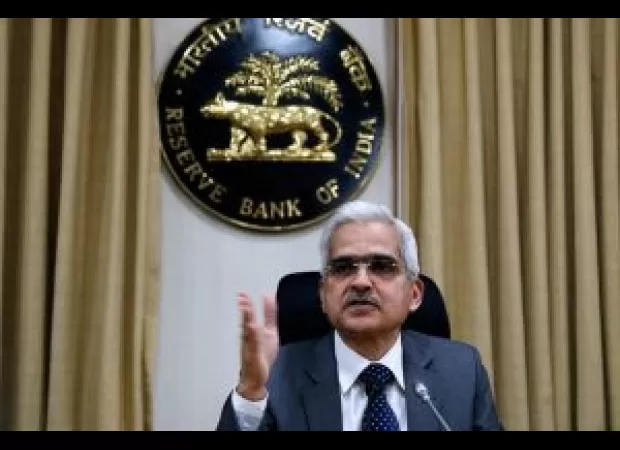

RBI Governor says it's too early to discuss changing interest rates due to current inflation levels.

Reserve Bank Governor Das says it's too early to consider changing interest rate stance due to gap between current inflation and 4% target.

Reserve Bank Governor Das says it's too early to consider changing interest rate stance due to gap between current inflation and 4% target.