RBA cautions that favorable circumstances are needed to maintain current rates after decision to keep them steady.

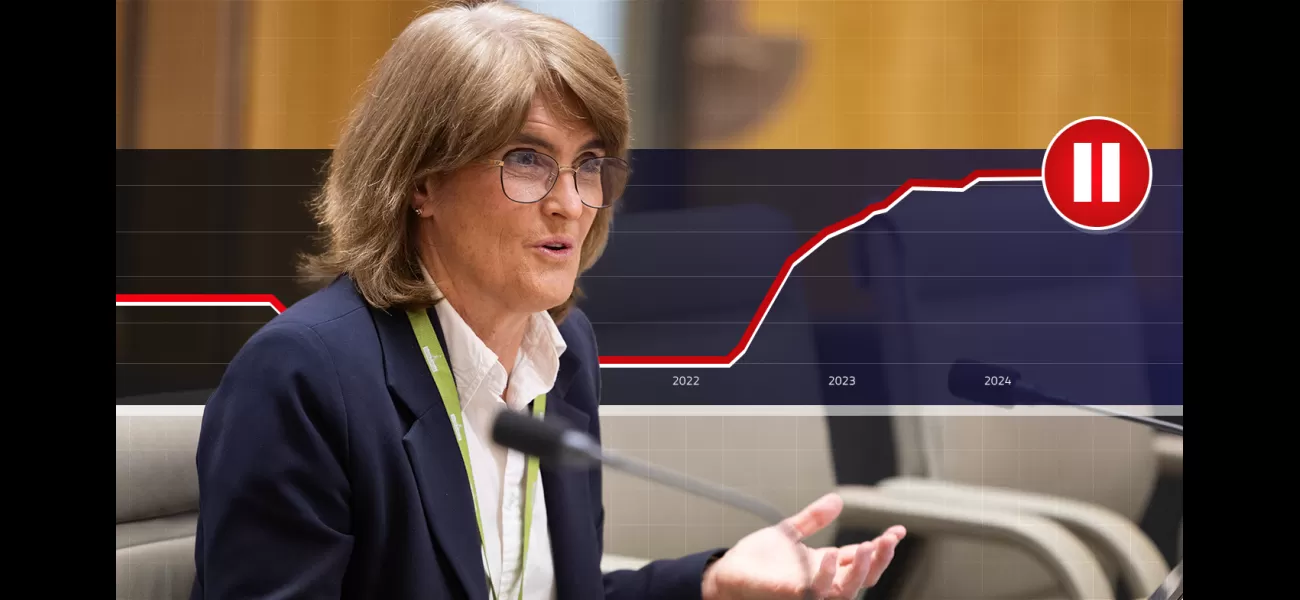

Reserve Bank keeps interest rates steady, potential for future hike, households anticipating long-awaited decrease.

June 18th 2024.

The Reserve Bank of Australia recently announced their decision to keep interest rates on hold, but they have not ruled out the possibility of another increase in the near future. This news has left many households on edge as they wait for a long-awaited rate cut.

During the meeting, RBA Governor Michele Bullock stated that the option of a rate hike was discussed, while the idea of lowering rates from their current 13-year high was not considered. She explained, "We believe we are on a narrow path, but it seems to be getting even narrower. We need a lot to go our way in order to bring inflation back down to our target range of 2-3 per cent. The board will do whatever is necessary to achieve this outcome."

Since the last rates decision in May, several important economic data has been released. Some of it, such as higher-than-expected inflation and a decrease in unemployment, may support the case for a rate increase. However, other data points to weakness in the economy. According to Bullock, the RBA is not ruling anything in or out, as the economic situation is proving to be complex and difficult to decipher.

She added, "I genuinely feel that we are facing a challenging time. I know there are those who are more certain and seem to know exactly what to do, but it's not that simple. We are constantly balancing risks on both sides." In the past, when rates were being raised, the decision was clear, but now, it is not as straightforward.

The current interest rate has remained unchanged since November 2023, and the financial market is anticipating a rate cut rather than an increase for the RBA's next move. In their monetary statement, the RBA board acknowledged the current financial conditions affecting Australian households and stated that more data is needed before making any changes to the rates.

"There is uncertainty surrounding consumption growth, but we expect it to pick up later in the year with the stabilization of disposable incomes and an increase in wealth due to housing prices," wrote Bullock and the board. However, there is a risk that consumption may not increase as expected, resulting in slow output growth and a decline in the labor market.

Despite this, the board did not disclose when rates would be cut, if at all. They stated, "While recent data has been mixed, it has reinforced the need to remain vigilant to potential inflation risks. The path of interest rates that will lead to a timely return of inflation to our target range is still uncertain."

Graham Cooke, head of consumer research at Finder, remarked that the decision may be disappointing for homeowners who were hoping for a rate cut to ease their financial burden. He stated, "With inflation showing no signs of decreasing significantly, the possibility of a rate cut seems even further away. Rising costs are relentless, causing significant financial strain for many."

Chief economist at CreditorWatch, Anneke Thompson, predicts that the next move for the RBA will be a rate cut, but it may not happen until next year. She explained, "Given the current challenges faced by Australian households and businesses, we do not expect the RBA to increase rates any further. Instead, we anticipate that they will keep rates at 4.35 per cent until early 2025 and then consider a decrease, especially as the impact of lower migration levels start to affect service inflation."

According to Steve Mickenbecker, Canstar's group executive of financial services, the slower progress towards the RBA's inflation target has resulted in a longer forecast timeline for most major lenders. He stated, "Unfortunately, this means that there is not much good news for borrowers. ANZ Bank has pushed back their projection for a rate cut to February 2025, while the other big banks are sticking to November 2024 for now. On the bright side, term deposit interest rates have increased slightly, with nine banks raising their rates by an average of 0.41 per cent. However, for borrowers, the impact of this was balanced out by three lenders who raised their interest rates last week."

During the meeting, RBA Governor Michele Bullock stated that the option of a rate hike was discussed, while the idea of lowering rates from their current 13-year high was not considered. She explained, "We believe we are on a narrow path, but it seems to be getting even narrower. We need a lot to go our way in order to bring inflation back down to our target range of 2-3 per cent. The board will do whatever is necessary to achieve this outcome."

Since the last rates decision in May, several important economic data has been released. Some of it, such as higher-than-expected inflation and a decrease in unemployment, may support the case for a rate increase. However, other data points to weakness in the economy. According to Bullock, the RBA is not ruling anything in or out, as the economic situation is proving to be complex and difficult to decipher.

She added, "I genuinely feel that we are facing a challenging time. I know there are those who are more certain and seem to know exactly what to do, but it's not that simple. We are constantly balancing risks on both sides." In the past, when rates were being raised, the decision was clear, but now, it is not as straightforward.

The current interest rate has remained unchanged since November 2023, and the financial market is anticipating a rate cut rather than an increase for the RBA's next move. In their monetary statement, the RBA board acknowledged the current financial conditions affecting Australian households and stated that more data is needed before making any changes to the rates.

"There is uncertainty surrounding consumption growth, but we expect it to pick up later in the year with the stabilization of disposable incomes and an increase in wealth due to housing prices," wrote Bullock and the board. However, there is a risk that consumption may not increase as expected, resulting in slow output growth and a decline in the labor market.

Despite this, the board did not disclose when rates would be cut, if at all. They stated, "While recent data has been mixed, it has reinforced the need to remain vigilant to potential inflation risks. The path of interest rates that will lead to a timely return of inflation to our target range is still uncertain."

Graham Cooke, head of consumer research at Finder, remarked that the decision may be disappointing for homeowners who were hoping for a rate cut to ease their financial burden. He stated, "With inflation showing no signs of decreasing significantly, the possibility of a rate cut seems even further away. Rising costs are relentless, causing significant financial strain for many."

Chief economist at CreditorWatch, Anneke Thompson, predicts that the next move for the RBA will be a rate cut, but it may not happen until next year. She explained, "Given the current challenges faced by Australian households and businesses, we do not expect the RBA to increase rates any further. Instead, we anticipate that they will keep rates at 4.35 per cent until early 2025 and then consider a decrease, especially as the impact of lower migration levels start to affect service inflation."

According to Steve Mickenbecker, Canstar's group executive of financial services, the slower progress towards the RBA's inflation target has resulted in a longer forecast timeline for most major lenders. He stated, "Unfortunately, this means that there is not much good news for borrowers. ANZ Bank has pushed back their projection for a rate cut to February 2025, while the other big banks are sticking to November 2024 for now. On the bright side, term deposit interest rates have increased slightly, with nine banks raising their rates by an average of 0.41 per cent. However, for borrowers, the impact of this was balanced out by three lenders who raised their interest rates last week."

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment