Location, Location, Location

Here are some “truisms” about startup investors and location that I’ve experienced and passed on over the years:

- Startup investors prefer to invest locally

- The younger the startup business, the more that is true

- Your lead investor/board member is more likely to be a local investor than your passive/follower investors

- The location preference is more pronounced with investors who are located in vibrant startup markets

- The location preference fades as companies mature

Last week Techcrunch published some numbers on the issue of location and startup investing using Crunchbase data on 36,700 startup investment rounds they have tracked from Q1 2012 through October 2017.

So let’s see what the numbers say about these truisms.

Startup Investors Prefer To Invest Locally

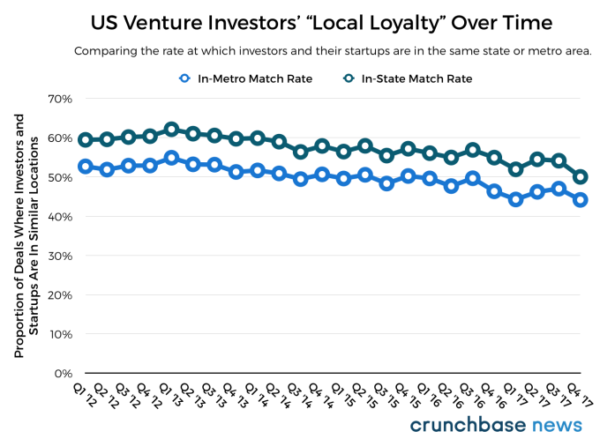

This is true, over half of all investors in startups are in the same state. But it appears that the location preference is declining over time, maybe brought on by the significant improvements in videoconferencing and other communications technologies.

The Younger The Startup, The More There Is A Location Preference

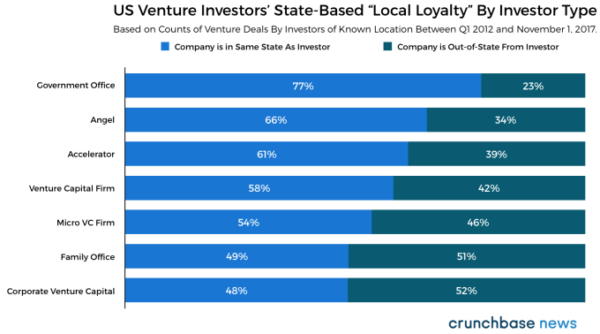

This is true. 66% of angel investments come from in state investors whereas only 58% of VC investments come from in state investors.

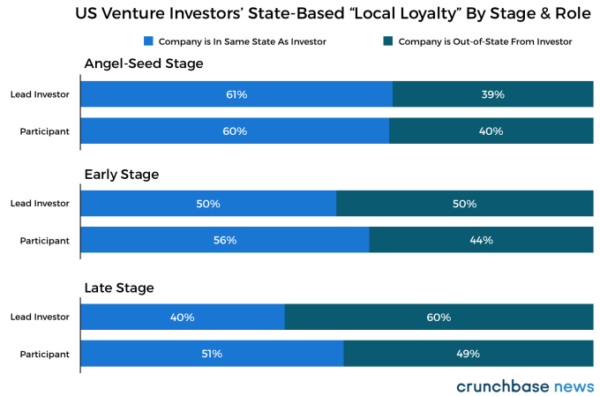

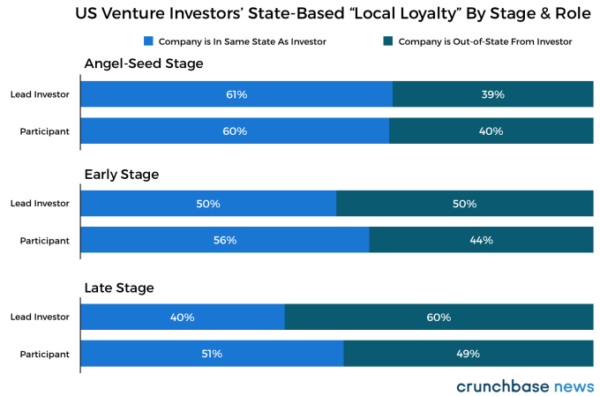

Lead Investors Tend To Have A Stronger Location Preference Than Passive Investors

This does not appear to be true.

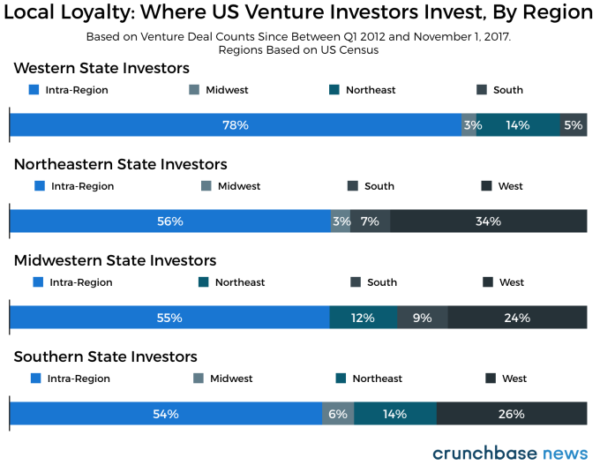

Location Preference Is More Pronounced In Vibrant Startup Markets

This is very true.

The Location Preference Fades As Companies Mature

This is very true.

At USV, about 25% of our investment activity is in NYC, 50% is rest of US, and 25% is outside of US. We are not completely location agnostic as we don’t invest very far away (South Asia, Asia, Middle East, Africa, etc) and we likely over-index on NYC vs the rest of the VC industry.

But the truth about being a startup investor, unless you are located in the bay area, is you have to go where the best opportunities are. That is particularly true if you are a thesis driven investor, as we are at USV.

So as much as I’d like to walk to my board meetings, that just isn’t reality. That said, I plan to walk to a board meeting on Tuesday.