I make £8,000 a month but I'm extremely thrifty, using old bin bags and owning only one plate.

He has over £200,000 in savings.

January 5th 2025.

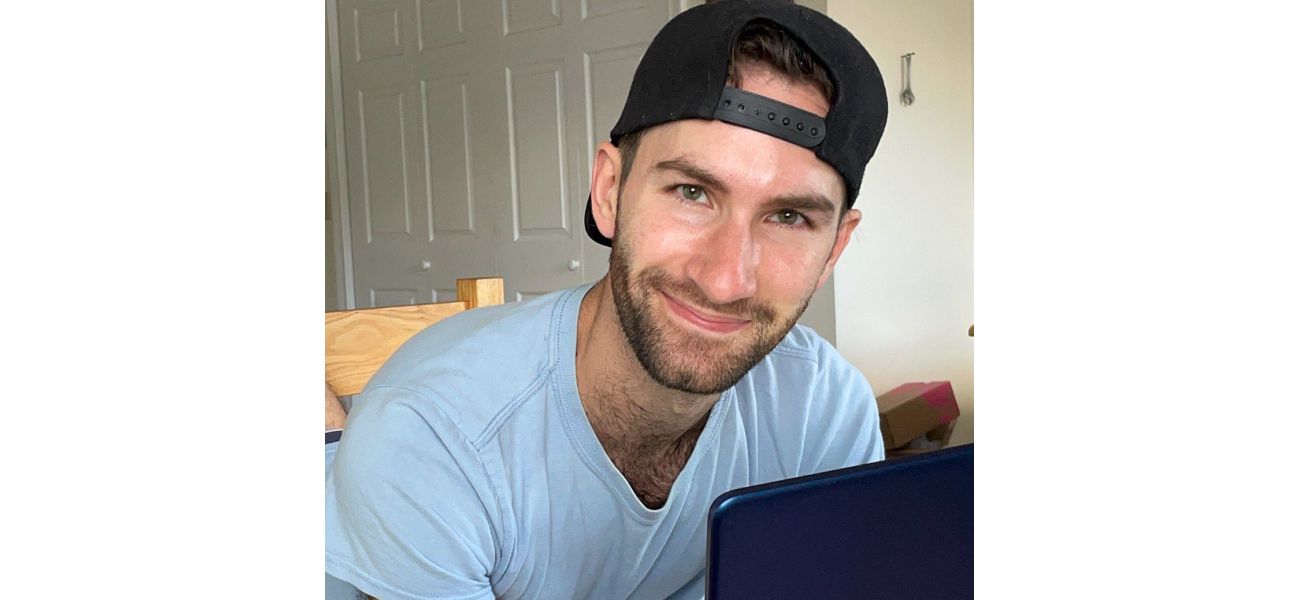

As we turn the page towards the next chapter, let's take a moment to reflect on the journey so far. In the month of December, Bradley, a 32-year-old from Connecticut, earned an impressive £16,067. With such a hefty sum at his disposal, one would imagine Bradley living a life of luxury, indulging in the latest gadgets, designer clothes, and Michelin-starred meals. However, Bradley chooses to live a more frugal lifestyle, spending only £1,026 in the same month.

Despite having the means to splurge, Bradley's biggest expense was his rent of £600 for his cozy studio apartment. He also spent £147 on groceries and cooked all his meals at home, considering eating out to be costly and unnecessary. In fact, Bradley is quite mindful of his expenses, unplugging all appliances when leaving the house and never turning on the heating, even during the chilly winters. This may seem extreme to some, but for Bradley, who prefers not to share his last name, it is a way to keep his finances in check. After all, he knows the struggles of being in debt all too well.

At the young age of 21, Bradley found himself burdened with a debt of over £100,000 after graduating from the prestigious Culinary Institute of America in New York. Unlike in the UK, student loans in the USA come with high-interest rates and require repayment regardless of income. Bradley recalls the moment when he first learned about his loan payments, which were estimated to be £1,120 per month. It was then that he decided to adopt a frugal lifestyle, viewing it as a necessary step towards financial stability.

Despite his loan payments being lower than expected, they still amount to a hefty £640 per month, leaving Bradley with limited funds for leisure activities, groceries, and other everyday expenses. But, through his determination and hard work, Bradley now earns a minimum of £8,000 per month through various jobs, including creating content for TikTok, working as a financial coach, dog sitting, answering crisis calls, cleaning houses, and mowing lawns.

Bradley's frugal ways may seem extreme to some, but to him, they are just a part of his daily routine. He has opted out of health insurance since turning 26 and no longer qualifying for his parents' plan. He also saves on electricity by using natural light to heat his apartment, wears layers of clothing, and even uses the heat from the stove while cooking to warm his hands. Bradley avoids eating out as much as possible and only indulges in the cheapest items on the menu, if necessary. He rarely buys new clothes or household items, using the same bath towels and bed sheets since moving into his apartment two years ago.

You may be surprised to hear that Bradley only owns one plate, which he has been using since his university days. He even cuts his sponges in half, believing that there's no need to waste a whole sponge for just one task. His daily meals consist of sweet potatoes and chicken with barbecue sauce, costing him only £1.50. Bradley also never buys bin bags, using paper bags instead, and making sure nothing goes to waste. He squeezes out every last bit of toothpaste, washing up liquid, and any other products he buys. He also doesn't have any subscriptions, preferring to relax by watching YouTube instead of wasting money on services like Netflix or TV.

Despite earning over £200,830 in savings and being able to pay off his student loan, which has now increased to £136,500 due to interest, Bradley continues to live a simple life. He keeps his food costs low by avoiding name brands and buying in bulk from his parents' wholesale membership. His bills are also reasonably low, with only £67 for car insurance, £47 for gas, and £41 for electricity, which he keeps low by being mindful of his energy usage. This includes unplugging his fridge when he's away and turning off all appliances when he leaves the house.

In a world where material possessions are often equated with success and happiness, Bradley's frugal lifestyle may seem unconventional. But for him, it's a way to stay financially secure and avoid the overwhelming debt that once consumed him. As he continues to earn a comfortable income, Bradley remains committed to his simple and budget-friendly ways, proving that a life of financial stability is worth more than any luxury or indulgence money can buy.

Bradley, a 32-year-old from Connecticut, has been making headlines recently for his impressive savings and frugal lifestyle. Despite earning a staggering £16,067 in just one month, he chooses to live modestly and spends only £1,026. This may seem like a drastic difference, but for Bradley, it's all about being financially responsible and avoiding the mistakes of his past.

You see, when Bradley was just 21, he found himself in over £100,000 of debt after graduating from university. Unlike in the UK, student loans in the USA come with high interest rates and require repayment regardless of income. Bradley had studied at the prestigious Culinary Institute of America in New York, but upon learning about his £104,150 debt bill, he felt like his life was over.

"I remember the moment when everything changed for me," Bradley reminisces. "They were showing me the numbers, and they were telling me I was gonna owe £1,120 a month. That's when I knew I had to make a change. That was the birth of my frugal lifestyle."

With monthly loan payments still reaching £640, Bradley had to make some tough choices. He cut back on "fun" expenses, groceries, and even everyday items like new clothes. But his determination paid off, and now, at 32, he earns at least £8,000 per month through various jobs, including creating content for TikTok, working as a financial coach, dog sitting, and more.

But Bradley's earnings haven't changed his frugal ways. In fact, he's become even more resourceful and extreme in his money-saving tactics. For example, he has not paid for health insurance in six years, opting out since he turned 26 and no longer qualified under his parents' plan. He also saves on electricity by not turning on the heat, using multiple layers of clothing and natural light to keep his apartment warm.

When it comes to food, Bradley avoids eating out at all costs and only splurges on the cheapest items on the menu. He rarely buys new clothes or household items, using the same plate and two bath towels for the past two years. He even cuts his sponges in half to make them last longer.

Despite his earnings, Bradley still lives a very simple life. He doesn't have any subscriptions like Netflix or TV, preferring to relax by watching YouTube instead. And he's not afraid to ask friends or coworkers for their old paper bags to use as bin liners.

Bradley's extreme money-saving habits have paid off, as he's amassed an impressive £200,830 in savings. He could easily pay off his student loan, which has now risen to £136,500 due to interest, but he chooses to keep living modestly. Even with his comfortable earnings, Bradley sticks to a strict budget when it comes to groceries, opting for store-brand items and buying in bulk to save money.

His bills are also surprisingly low, with only £67 for car insurance, £47 for gas, and £41 for electricity. Bradley credits this to his energy-saving habits, such as unplugging appliances and turning off lights when he's not using them.

Some may find Bradley's lifestyle extreme, but for him, it's all about maintaining control over his finances and avoiding the mistakes of his past. He may have enough money to live lavishly, but he chooses to live frugally and save for the future. As Bradley puts it, "Nothing goes to waste. Every time I buy something, I make sure to squeeze out every last bit - from toothpaste to washing up liquid."

Despite having the means to splurge, Bradley's biggest expense was his rent of £600 for his cozy studio apartment. He also spent £147 on groceries and cooked all his meals at home, considering eating out to be costly and unnecessary. In fact, Bradley is quite mindful of his expenses, unplugging all appliances when leaving the house and never turning on the heating, even during the chilly winters. This may seem extreme to some, but for Bradley, who prefers not to share his last name, it is a way to keep his finances in check. After all, he knows the struggles of being in debt all too well.

At the young age of 21, Bradley found himself burdened with a debt of over £100,000 after graduating from the prestigious Culinary Institute of America in New York. Unlike in the UK, student loans in the USA come with high-interest rates and require repayment regardless of income. Bradley recalls the moment when he first learned about his loan payments, which were estimated to be £1,120 per month. It was then that he decided to adopt a frugal lifestyle, viewing it as a necessary step towards financial stability.

Despite his loan payments being lower than expected, they still amount to a hefty £640 per month, leaving Bradley with limited funds for leisure activities, groceries, and other everyday expenses. But, through his determination and hard work, Bradley now earns a minimum of £8,000 per month through various jobs, including creating content for TikTok, working as a financial coach, dog sitting, answering crisis calls, cleaning houses, and mowing lawns.

Bradley's frugal ways may seem extreme to some, but to him, they are just a part of his daily routine. He has opted out of health insurance since turning 26 and no longer qualifying for his parents' plan. He also saves on electricity by using natural light to heat his apartment, wears layers of clothing, and even uses the heat from the stove while cooking to warm his hands. Bradley avoids eating out as much as possible and only indulges in the cheapest items on the menu, if necessary. He rarely buys new clothes or household items, using the same bath towels and bed sheets since moving into his apartment two years ago.

You may be surprised to hear that Bradley only owns one plate, which he has been using since his university days. He even cuts his sponges in half, believing that there's no need to waste a whole sponge for just one task. His daily meals consist of sweet potatoes and chicken with barbecue sauce, costing him only £1.50. Bradley also never buys bin bags, using paper bags instead, and making sure nothing goes to waste. He squeezes out every last bit of toothpaste, washing up liquid, and any other products he buys. He also doesn't have any subscriptions, preferring to relax by watching YouTube instead of wasting money on services like Netflix or TV.

Despite earning over £200,830 in savings and being able to pay off his student loan, which has now increased to £136,500 due to interest, Bradley continues to live a simple life. He keeps his food costs low by avoiding name brands and buying in bulk from his parents' wholesale membership. His bills are also reasonably low, with only £67 for car insurance, £47 for gas, and £41 for electricity, which he keeps low by being mindful of his energy usage. This includes unplugging his fridge when he's away and turning off all appliances when he leaves the house.

In a world where material possessions are often equated with success and happiness, Bradley's frugal lifestyle may seem unconventional. But for him, it's a way to stay financially secure and avoid the overwhelming debt that once consumed him. As he continues to earn a comfortable income, Bradley remains committed to his simple and budget-friendly ways, proving that a life of financial stability is worth more than any luxury or indulgence money can buy.

Bradley, a 32-year-old from Connecticut, has been making headlines recently for his impressive savings and frugal lifestyle. Despite earning a staggering £16,067 in just one month, he chooses to live modestly and spends only £1,026. This may seem like a drastic difference, but for Bradley, it's all about being financially responsible and avoiding the mistakes of his past.

You see, when Bradley was just 21, he found himself in over £100,000 of debt after graduating from university. Unlike in the UK, student loans in the USA come with high interest rates and require repayment regardless of income. Bradley had studied at the prestigious Culinary Institute of America in New York, but upon learning about his £104,150 debt bill, he felt like his life was over.

"I remember the moment when everything changed for me," Bradley reminisces. "They were showing me the numbers, and they were telling me I was gonna owe £1,120 a month. That's when I knew I had to make a change. That was the birth of my frugal lifestyle."

With monthly loan payments still reaching £640, Bradley had to make some tough choices. He cut back on "fun" expenses, groceries, and even everyday items like new clothes. But his determination paid off, and now, at 32, he earns at least £8,000 per month through various jobs, including creating content for TikTok, working as a financial coach, dog sitting, and more.

But Bradley's earnings haven't changed his frugal ways. In fact, he's become even more resourceful and extreme in his money-saving tactics. For example, he has not paid for health insurance in six years, opting out since he turned 26 and no longer qualified under his parents' plan. He also saves on electricity by not turning on the heat, using multiple layers of clothing and natural light to keep his apartment warm.

When it comes to food, Bradley avoids eating out at all costs and only splurges on the cheapest items on the menu. He rarely buys new clothes or household items, using the same plate and two bath towels for the past two years. He even cuts his sponges in half to make them last longer.

Despite his earnings, Bradley still lives a very simple life. He doesn't have any subscriptions like Netflix or TV, preferring to relax by watching YouTube instead. And he's not afraid to ask friends or coworkers for their old paper bags to use as bin liners.

Bradley's extreme money-saving habits have paid off, as he's amassed an impressive £200,830 in savings. He could easily pay off his student loan, which has now risen to £136,500 due to interest, but he chooses to keep living modestly. Even with his comfortable earnings, Bradley sticks to a strict budget when it comes to groceries, opting for store-brand items and buying in bulk to save money.

His bills are also surprisingly low, with only £67 for car insurance, £47 for gas, and £41 for electricity. Bradley credits this to his energy-saving habits, such as unplugging appliances and turning off lights when he's not using them.

Some may find Bradley's lifestyle extreme, but for him, it's all about maintaining control over his finances and avoiding the mistakes of his past. He may have enough money to live lavishly, but he chooses to live frugally and save for the future. As Bradley puts it, "Nothing goes to waste. Every time I buy something, I make sure to squeeze out every last bit - from toothpaste to washing up liquid."

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment