Growth Is A Bitch

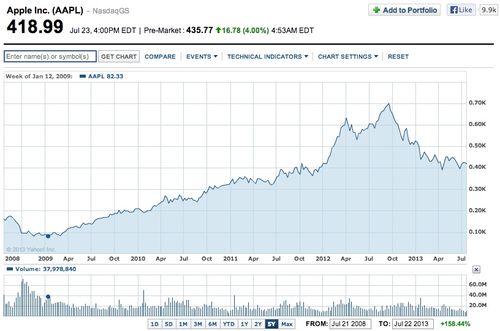

Dan Frommer writes that Apple's decade of blistering growth has, at least temporarily, come to a halt. And you can see that in the stock:

Companies are worth a multiple of their earnings and that multiple is directly related to earnings growth rates. When you are growing rapidly, you are worth more.

But living forever and growing forever have something in common. You can't do it.

I was talking to the CEO of one of our portfolio companies that has grown at close to 100% per year for the past five or six years yesterday. And we lamented about the law of large numbers. Growing at 100% a year when your top line is in the billions is a lot harder than growing at 100% a year when your top line is $25mm.

Of course, you can come up with new lines of business, new hit products, or make acquisitions to keep on the growth treadmill. But recognize that is what you are on. You can and will become a slave to it.

Startups and their rich uncle pennybags (VCs) are particular slaves to this drug. We build and finance companies that are designed to grow and grow and grow. That's how we create wealth, jobs, and impact. It's a fantastic ride that I cannot get off. But these rides do slow down and even end sometimes. And that's a bitch.