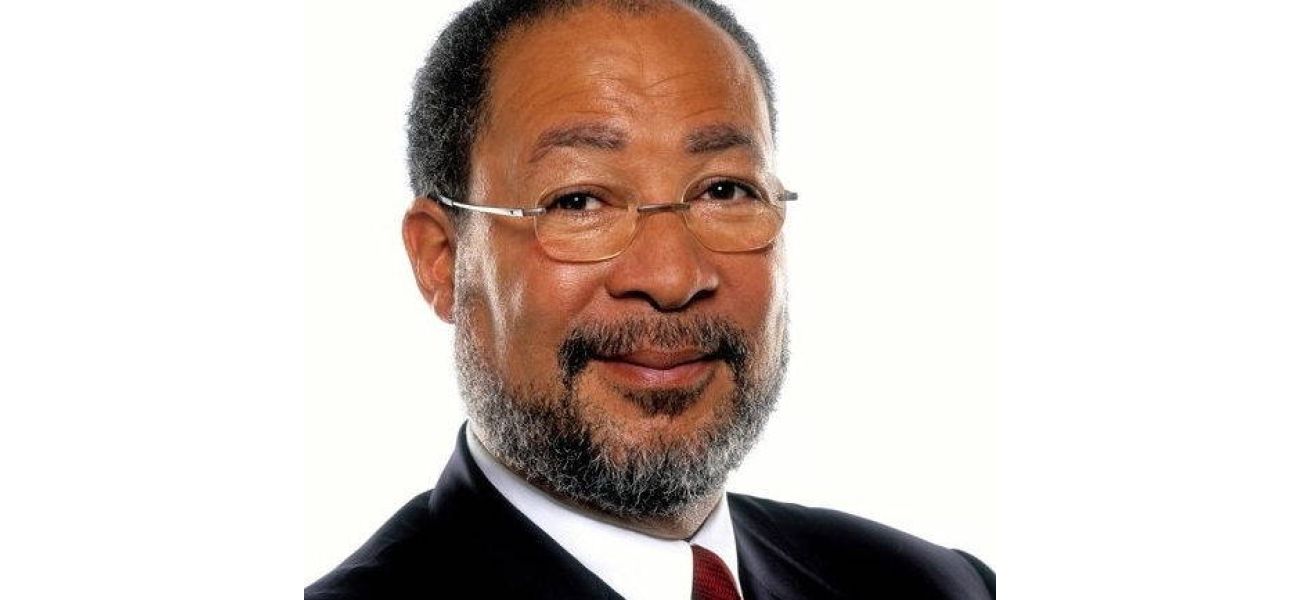

Dick Parsons: Celebrating an honorable man of integrity.

NY & American business communities grieve the death of Dick Parsons, also mourned by Feigen Advisors, where he served as chairman.

February 27th 2025.

Marc Feigen, a renowned writer, recently wrote about the passing of Richard "Dick" Parsons, a beloved figure in the New York and American business communities. Feigen Advisors, a prestigious firm, also mourned the loss of their chairman of the Advisory Board and first friend. Parsons played a crucial role in the early years of the firm, providing them with seed capital and introducing them to Fortune 250. He was a mentor to all their clients, especially newly appointed CEOs, and even to Feigen himself. The firm extends their thoughts and condolences to Parsons' wife, Laura, and their children and grandchildren.

Parsons was not just known for his calm demeanor, but he also grew calmer as the pressure rose. His presence had a calming effect on those around him, and his sharp mind brought clarity to complex situations. He was a master of spoken word, often using his convincing and unexpected dimension to sway others. Standing at 6'4", Parsons commanded respect with his James Earl Jones-like baritone voice, and everyone listened when he spoke. With his warm smile, glint in his eye, and friendly fist bump, he was a friend to all.

Parsons was not afraid to take on challenges, no matter how daunting they may seem. When the Savings & Loan crisis struck, he was chosen to run the Dime Savings and Loan. He was also asked to be the CEO of AOL-Time Warner during the largest failed merger in history. When the owner of the LA Clippers made racists remarks about his players, Parsons was called upon by the NBA to lead the team.

However, his greatest achievement was saving Citigroup from insolvency during the financial crisis. Feigen recalls a conversation with him in an elevator bank, where Parsons admitted that they only had six weeks to turn things around. He also acknowledged that there were others who were more qualified to lead Citigroup, but President Obama chose him for the job. Parsons' selfless example inspired others to do the same, and his calm demeanor helped ease tensions between bankers and regulators. He also made tough decisions, such as replacing board members and directing the work of the CEO, to ensure the bank's survival.

Feigen shared an interesting tidbit about Parsons' past - he had finished second in the national Moot Court competition while in law school, but that was probably the last time he ever came in second. He successfully saved the Dime, helped Citigroup grow again, and eventually sold the Clippers to Steve Balmer. When Carl Icahn, an activist shareholder, held a news conference on the roof of St. Regis to announce his choice for CEO of Time Warner, Parsons calmly walked into his office and said, "Nice party, but you don't have the votes. I do." On another occasion, Parsons brought a birthday cake to Icahn's office, and after realizing that Parsons did, in fact, have the votes, Carl made a deal and left.

When Feigen founded his firm, he asked Parsons to chair the advisory board. Parsons invited him to his office, where they listened to low-volume jazz and sat next to a large Bugs Bunny overlooking Central Park. After reading their business plan, Parsons compared their partnership to that of Clint Eastwood and Morgan Freeman in "Million Dollar Baby." He also shared his views on the role of a CEO, telling clients that they have only one natural predator - the Board. He encouraged new CEOs to work towards their legacy from day one and reminded them that their two main jobs were to leave their company in great shape and in good hands.

Feigen recalls Parsons' storytelling abilities, comparing them to that of Abraham Lincoln. He shared a few humorous stories, such as the time Parsons unknowingly tried to drink a finger bowl at Happy and David Rockefeller's home, mistaking it for soup. Parsons later joked, "We didn't have finger bowls in the Bronx."

Parsons' legacy will live on through his contributions to the business world and the lives he touched. He will be deeply missed by all who knew him.

Marc Feigen writes about the recent passing of Richard “Dick” Parsons and how it has affected both the New York and American business communities. As the chairman of our firm's Advisory Board and our firm's first friend, Dick's loss is deeply felt by Feigen Advisors. In fact, he played a significant role in the founding years of our firm by providing invaluable seed capital: his good name. He introduced us to the Fortune 250 and provided guidance to all of our clients, especially those who were newly appointed CEOs. He also took the time to counsel me personally. Our thoughts and condolences go out to his wife, Laura Parsons, and their children and grandchildren during this difficult time.

Dick was known for his calm demeanor, even in the face of pressure. In fact, he seemed to become even calmer as the pressure rose. His calmness had a calming effect on those around him. He had a sharp mind that was able to bring clarity to even the most complex situations. His words were like magic, often persuading others with unexpected yet convincing arguments. Standing at 6'4" with a deep baritone voice, people couldn't help but listen when Dick spoke. His warm smile, mischievous glint in his eye, and friendly fist bump made him everyone's friend.

Dick was always ready to tackle challenges head-on. When the Savings & Loan crisis hit, he was chosen to run the Dime Savings and Loan. And when the largest merger in history failed, he was called upon to be the CEO of AOL-Time Warner. When the owner of the LA Clippers made racist remarks about his players, it was Dick who was asked to lead the team by the NBA.

One of Dick's greatest legacies was his role in saving Citigroup from insolvency. I remember him telling me in an elevator bank, "Marc, we only have six weeks and I'm not sure if we can make it." At the time, the White House had just asked him to become the chairman of Citigroup during the gravest moment of the financial crisis. Despite knowing that there were other leaders with more expertise in finance, regulation, and restructuring, President Obama chose Dick for the job. His selfless example inspired others to be selfless, and his calmness helped ease tensions during a time of crisis. Through sheer determination, he was able to get bankers and regulators to compromise, and he even replaced many members of the Citigroup board of directors. He set clear goals, found common ground, and didn't hesitate to dismiss those who were only looking out for their own interests.

During law school, Dick placed second in the national Moot Court competition, but that may have been the last time he came in second place. He successfully saved the Dime, helped Citigroup survive and thrive, and even sold the Clippers to Steve Balmer. When activist shareholder Carl Icahn held a showy news conference on the roof of St Regis to announce his choice to replace Dick as CEO of Time Warner, Dick simply walked over to Icahn's office to meet with him. He told Carl, "Nice party, but you don't have the votes. I do." On another occasion, he brought a birthday cake to Carl's office, and it turned out he did indeed have the votes. Carl made a deal and went away.

When I approached Dick to chair our advisory board at Feigen Advisors, he invited me to his office. There was low-volume jazz playing in the background, and a large Bugs Bunny sitting on his desk overlooking Central Park. After reading our business plan, he pointed to me and said, "Clint Eastwood." Then, pointing to himself, he said, "Morgan Freeman." And finally, pointing to the two of us, he said, "Million Dollar Baby."

When meeting with our firm's clients, Dick often shared his wisdom and insights. He would tell them, "As CEO, your only natural predator is the Board." He would also remind them to focus on their legacy from day one. In fact, he would say, "You only have two jobs as CEO: leave your company in great shape and in good hands."

Dick was a great storyteller, much like Lincoln. Here are a few of his famous anecdotes: "One year, my CFO told me we couldn't sign the financial statements, which is required by law for both the CFO and CEO. I knew that if we didn't sign, the company would go bankrupt. So, I signed." And when he was invited to dine with Happy and David Rockefeller at their home on the Hudson River, he mistook the finger bowl for soup and started drinking from it. "I thought it was soup! We didn't have finger bowls in the Bronx."

Parsons was not just known for his calm demeanor, but he also grew calmer as the pressure rose. His presence had a calming effect on those around him, and his sharp mind brought clarity to complex situations. He was a master of spoken word, often using his convincing and unexpected dimension to sway others. Standing at 6'4", Parsons commanded respect with his James Earl Jones-like baritone voice, and everyone listened when he spoke. With his warm smile, glint in his eye, and friendly fist bump, he was a friend to all.

Parsons was not afraid to take on challenges, no matter how daunting they may seem. When the Savings & Loan crisis struck, he was chosen to run the Dime Savings and Loan. He was also asked to be the CEO of AOL-Time Warner during the largest failed merger in history. When the owner of the LA Clippers made racists remarks about his players, Parsons was called upon by the NBA to lead the team.

However, his greatest achievement was saving Citigroup from insolvency during the financial crisis. Feigen recalls a conversation with him in an elevator bank, where Parsons admitted that they only had six weeks to turn things around. He also acknowledged that there were others who were more qualified to lead Citigroup, but President Obama chose him for the job. Parsons' selfless example inspired others to do the same, and his calm demeanor helped ease tensions between bankers and regulators. He also made tough decisions, such as replacing board members and directing the work of the CEO, to ensure the bank's survival.

Feigen shared an interesting tidbit about Parsons' past - he had finished second in the national Moot Court competition while in law school, but that was probably the last time he ever came in second. He successfully saved the Dime, helped Citigroup grow again, and eventually sold the Clippers to Steve Balmer. When Carl Icahn, an activist shareholder, held a news conference on the roof of St. Regis to announce his choice for CEO of Time Warner, Parsons calmly walked into his office and said, "Nice party, but you don't have the votes. I do." On another occasion, Parsons brought a birthday cake to Icahn's office, and after realizing that Parsons did, in fact, have the votes, Carl made a deal and left.

When Feigen founded his firm, he asked Parsons to chair the advisory board. Parsons invited him to his office, where they listened to low-volume jazz and sat next to a large Bugs Bunny overlooking Central Park. After reading their business plan, Parsons compared their partnership to that of Clint Eastwood and Morgan Freeman in "Million Dollar Baby." He also shared his views on the role of a CEO, telling clients that they have only one natural predator - the Board. He encouraged new CEOs to work towards their legacy from day one and reminded them that their two main jobs were to leave their company in great shape and in good hands.

Feigen recalls Parsons' storytelling abilities, comparing them to that of Abraham Lincoln. He shared a few humorous stories, such as the time Parsons unknowingly tried to drink a finger bowl at Happy and David Rockefeller's home, mistaking it for soup. Parsons later joked, "We didn't have finger bowls in the Bronx."

Parsons' legacy will live on through his contributions to the business world and the lives he touched. He will be deeply missed by all who knew him.

Marc Feigen writes about the recent passing of Richard “Dick” Parsons and how it has affected both the New York and American business communities. As the chairman of our firm's Advisory Board and our firm's first friend, Dick's loss is deeply felt by Feigen Advisors. In fact, he played a significant role in the founding years of our firm by providing invaluable seed capital: his good name. He introduced us to the Fortune 250 and provided guidance to all of our clients, especially those who were newly appointed CEOs. He also took the time to counsel me personally. Our thoughts and condolences go out to his wife, Laura Parsons, and their children and grandchildren during this difficult time.

Dick was known for his calm demeanor, even in the face of pressure. In fact, he seemed to become even calmer as the pressure rose. His calmness had a calming effect on those around him. He had a sharp mind that was able to bring clarity to even the most complex situations. His words were like magic, often persuading others with unexpected yet convincing arguments. Standing at 6'4" with a deep baritone voice, people couldn't help but listen when Dick spoke. His warm smile, mischievous glint in his eye, and friendly fist bump made him everyone's friend.

Dick was always ready to tackle challenges head-on. When the Savings & Loan crisis hit, he was chosen to run the Dime Savings and Loan. And when the largest merger in history failed, he was called upon to be the CEO of AOL-Time Warner. When the owner of the LA Clippers made racist remarks about his players, it was Dick who was asked to lead the team by the NBA.

One of Dick's greatest legacies was his role in saving Citigroup from insolvency. I remember him telling me in an elevator bank, "Marc, we only have six weeks and I'm not sure if we can make it." At the time, the White House had just asked him to become the chairman of Citigroup during the gravest moment of the financial crisis. Despite knowing that there were other leaders with more expertise in finance, regulation, and restructuring, President Obama chose Dick for the job. His selfless example inspired others to be selfless, and his calmness helped ease tensions during a time of crisis. Through sheer determination, he was able to get bankers and regulators to compromise, and he even replaced many members of the Citigroup board of directors. He set clear goals, found common ground, and didn't hesitate to dismiss those who were only looking out for their own interests.

During law school, Dick placed second in the national Moot Court competition, but that may have been the last time he came in second place. He successfully saved the Dime, helped Citigroup survive and thrive, and even sold the Clippers to Steve Balmer. When activist shareholder Carl Icahn held a showy news conference on the roof of St Regis to announce his choice to replace Dick as CEO of Time Warner, Dick simply walked over to Icahn's office to meet with him. He told Carl, "Nice party, but you don't have the votes. I do." On another occasion, he brought a birthday cake to Carl's office, and it turned out he did indeed have the votes. Carl made a deal and went away.

When I approached Dick to chair our advisory board at Feigen Advisors, he invited me to his office. There was low-volume jazz playing in the background, and a large Bugs Bunny sitting on his desk overlooking Central Park. After reading our business plan, he pointed to me and said, "Clint Eastwood." Then, pointing to himself, he said, "Morgan Freeman." And finally, pointing to the two of us, he said, "Million Dollar Baby."

When meeting with our firm's clients, Dick often shared his wisdom and insights. He would tell them, "As CEO, your only natural predator is the Board." He would also remind them to focus on their legacy from day one. In fact, he would say, "You only have two jobs as CEO: leave your company in great shape and in good hands."

Dick was a great storyteller, much like Lincoln. Here are a few of his famous anecdotes: "One year, my CFO told me we couldn't sign the financial statements, which is required by law for both the CFO and CEO. I knew that if we didn't sign, the company would go bankrupt. So, I signed." And when he was invited to dine with Happy and David Rockefeller at their home on the Hudson River, he mistook the finger bowl for soup and started drinking from it. "I thought it was soup! We didn't have finger bowls in the Bronx."

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment