China is providing large sums of money to rescue its troubled real estate industry.

China takes action to revive struggling real estate sector by buying back unsold homes and idle lands, a key contributor to its economic growth.

May 19th 2024.

After much deliberation, the Chinese government has finally announced a plan to tackle the severe crisis in its property sector. This crisis has caused widespread concern as it has been a major contributor to China's economic growth in the past. To address this issue, billions of dollars will be allocated towards buying back unsold homes and repurchasing unused land in an effort to revive the struggling real estate industry.

The People's Bank of China has stated that it will establish a 300-billion-yuan facility to support government-subsidized housing projects. Deputy governor Tao Ling has encouraged state-owned enterprises to use these funds to purchase affordable commercial homes that are already completed. These homes will then be used to provide much-needed affordable housing for the people.

In addition to this, commercial banks across the nation have issued a massive amount of loans for real estate development and individual housing in the first quarter of this year. This shows the government's commitment to supporting the property sector and helping it recover from its current state. The newly established fund will also assist developers in obtaining financing and encourage the repurchase of idle land. Meanwhile, the relending funds will enable state-owned enterprises to buy unsold homes and offer them as affordable housing.

The Chinese media reports that the property sector is not only significant in terms of its size, but it also has a major impact on other sectors of the economy. Furthermore, property plays a crucial role in the wealth of Chinese households. Just like how the rescue of systemically important financial institutions was necessary to prevent a financial crisis 16 years ago, some experts believe that major property developers in China may also be too interconnected to fail.

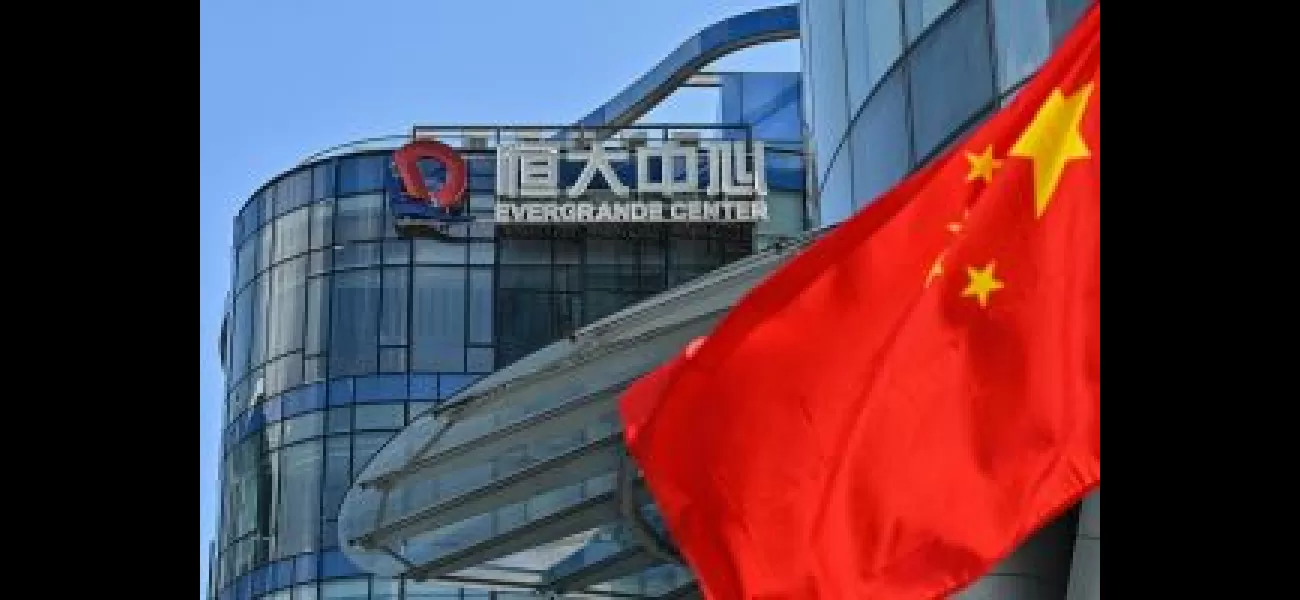

The recent crisis in China's property sector has been viewed as a major setback for the country's economy, with the default of the biggest property developer, Evergrande Group, in 2021. This company has reported over $300 billion in liabilities and its liquidation has caused ripple effects across China and the world. Other real estate developers such as Kaisa Group, Country Garden, and Fantasia Holdings have also declared bankruptcy due to millions of unsold and partially developed residential high-rises.

Despite the Hong Kong court's decision to liquidate Evergrande in January, analysts believe that this may not be the end of China's property debt crisis. As this crisis continues to weigh down on the world's second-largest economy, the Chinese government has finally taken measures to address it. In addition to the $42.25 billion fund, they have also announced other measures such as reducing minimum down payment ratios and setting up a relending facility for affordable housing. These efforts are aimed at boosting the property market and delivering unfinished homes to buyers. According to experts, the lowering of down payment requirements to its lowest in history will greatly assist in reviving the property market.

The People's Bank of China has stated that it will establish a 300-billion-yuan facility to support government-subsidized housing projects. Deputy governor Tao Ling has encouraged state-owned enterprises to use these funds to purchase affordable commercial homes that are already completed. These homes will then be used to provide much-needed affordable housing for the people.

In addition to this, commercial banks across the nation have issued a massive amount of loans for real estate development and individual housing in the first quarter of this year. This shows the government's commitment to supporting the property sector and helping it recover from its current state. The newly established fund will also assist developers in obtaining financing and encourage the repurchase of idle land. Meanwhile, the relending funds will enable state-owned enterprises to buy unsold homes and offer them as affordable housing.

The Chinese media reports that the property sector is not only significant in terms of its size, but it also has a major impact on other sectors of the economy. Furthermore, property plays a crucial role in the wealth of Chinese households. Just like how the rescue of systemically important financial institutions was necessary to prevent a financial crisis 16 years ago, some experts believe that major property developers in China may also be too interconnected to fail.

The recent crisis in China's property sector has been viewed as a major setback for the country's economy, with the default of the biggest property developer, Evergrande Group, in 2021. This company has reported over $300 billion in liabilities and its liquidation has caused ripple effects across China and the world. Other real estate developers such as Kaisa Group, Country Garden, and Fantasia Holdings have also declared bankruptcy due to millions of unsold and partially developed residential high-rises.

Despite the Hong Kong court's decision to liquidate Evergrande in January, analysts believe that this may not be the end of China's property debt crisis. As this crisis continues to weigh down on the world's second-largest economy, the Chinese government has finally taken measures to address it. In addition to the $42.25 billion fund, they have also announced other measures such as reducing minimum down payment ratios and setting up a relending facility for affordable housing. These efforts are aimed at boosting the property market and delivering unfinished homes to buyers. According to experts, the lowering of down payment requirements to its lowest in history will greatly assist in reviving the property market.

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment