Big Insurance Met Its Match When It Turned Down a Top Trial Lawyer’s Request for Cancer Treatment

A vaccine against tuberculosis has never been closer to reality. But its development slowed after its corporate owner focused on more profitable vaccines.

In August 2018, Robert Salim and eight of his friends and relatives flew to the steamy heat of New York City to watch the U.S. Open.

The group — most of them lawyers who were old tennis buddies from college — gathered every few years to attend the championship. They raced from court to court to catch as many matches as possible. They hung out at bars, splurged on high-priced meals and caught up on each others’ lives.

But that year, Salim had trouble walking the half-mile from the subway station to the Billie Jean King National Tennis Center in Flushing Meadows without stopping two or three times to rest. Back in his hotel room, he was coughing badly, his phlegm speckled with spots of blood. Although he had kept fit for a 67-year-old, he felt ragged.

Salim, whose friends call him Skeeter, flew home to Houston, where he saw his family doctor. After dozens of tests and visits to specialists, he received his diagnosis: stage 4 throat cancer. A tumor almost an inch long was growing under the back of his tongue, lodged like a rock. It had spread to his lymph nodes. Dr. Clifton Fuller, his oncologist at the MD Anderson Cancer Center, called it “massive oral disease.”

Still, Fuller told Salim that his type of throat cancer would respond well to a treatment known as proton therapy, which focuses a tight beam of radiation on a tumor. So Fuller’s staff quickly sought approval from Salim’s health insurer, marking its fax “URGENT REQUEST”: “Please treat this request as expedited based on the patient’s diagnosis which is considered life threatening.”

The answer arrived two days later. Blue Cross and Blue Shield of Louisiana would not pay for proton therapy; the costly procedure was appropriate only after doctors had previously tried other methods for irradiating the head and neck. “This treatment is not medically necessary for you,” the rejection letter read.

Fuller told Salim that he might have to use a cheaper form of radiation that is less precise. Normally outgoing and optimistic, Salim felt his chest tighten as Fuller described the possible side effects of that other type of treatment. Because there were many critical organs near Salim’s tumor, the damage could be severe, causing loss of hearing, diminished sense of taste and smell, and brain impairment, like memory loss.

At that point, Salim seemed in danger of joining millions of other Americans denied payment for medical treatment. These patients often settle for outdated, riskier procedures or simply forgo care.

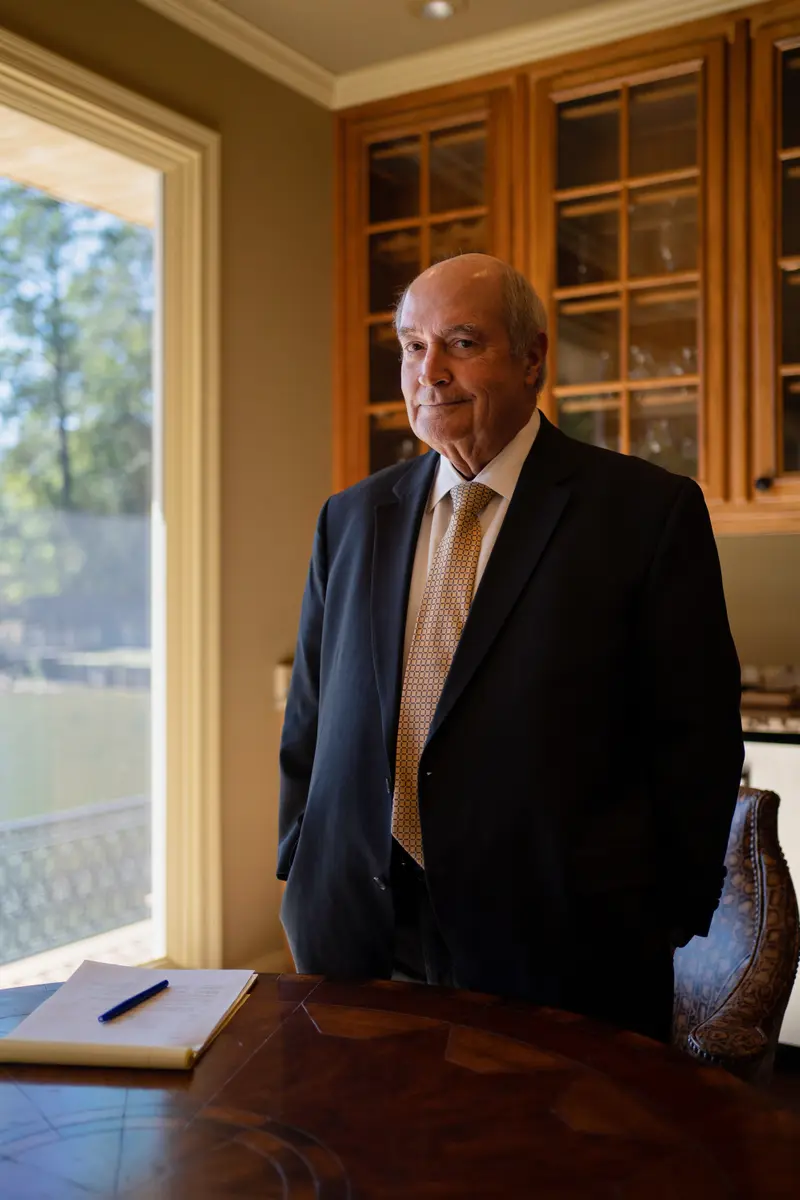

But Salim was no ordinary patient. He was, in fact, an aggressive litigator who had been named one of the 100 best trial lawyers in America. In a long career working from Natchitoches, Louisiana, a tiny city in the Creole heartland, he had helped extract settlements worth hundreds of millions of dollars from massive corporations that had harmed consumers with unsafe products, including pelvic mesh and the pain reliever Vioxx.

Salim decided to do what few people can afford to do. He paid MD Anderson $95,862.95 for his proton therapy and readied for a battle with Blue Cross, the biggest insurance company in Louisiana. As always, Skeeter Salim was determined to win.

It would be Goliath vs. Goliath.

“It’s not about the money for me. I’ve been blessed and we have an extremely lucrative practice,” said Salim, a broad-set man quick with jokes. “But I would like to see other people that are not in the same situation not get run over by these people. There’s no telling how many billions the insurers made by denying claims on a bogus basis.”

Blue Cross and Blue Shield of Louisiana declined to comment, citing ongoing litigation.

In his decades as a plaintiff’s lawyer, Salim had relied upon consumer protection laws and billion-dollar judgments to make companies fix their bad practices. But now he stood on different terrain, facing a 1970s-era federal law that deprived patients of tools to fight, let alone change, abuses by the insurance industry.

And interviews, court documents and previously confidential emails and records from Blue Cross, its contractors and MD Anderson would expose the inner workings of a large insurer and an unnerving truth: To overcome a system tilted heavily in favor of the insurance industry, you need money, a dogged doctor and a friend with unusual skills.

“Arbitrary and Capricious”Salim was angry. For years, he had paid Blue Cross more than $100,000 in annual premiums to cover himself, the employees of his law firm and their family members.

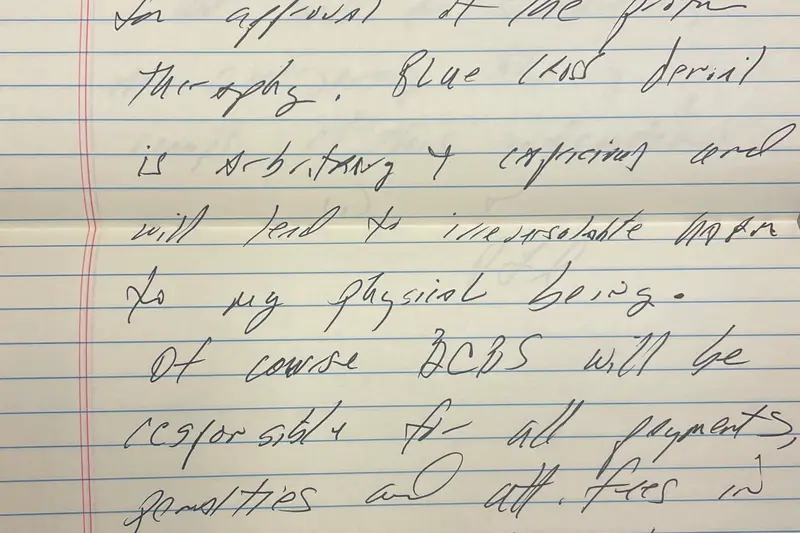

In mid-October 2018, he scrawled a note on a legal pad: “Blue Cross’ denial is arbitrary and capricious and will lead to irreversible harm to my physical being.”

And so Salim began his unusual journey to appeal an insurance company rejection. Few patients ever do so. One study of Obamacare health plans purchased on healthcare.gov found that less than 1% of people tried to overturn claim denials.

When a patient files an appeal, insurance company doctors are supposed to take a fresh look to reconsider the denial, relying on medical guidelines, their own clinical experience, scientific studies and the recommendations of professional societies.

But the insurance industry doctors who shot down Salim’s appeal did little to consult outside sources, a ProPublica review found. They cut and pasted guidelines created by a company called AIM Specialty Health: “The requested proton beam therapy is not medically necessary for this patient,” one rejection letter read.

Many insurers won’t pay for certain specialized or expensive treatments unless a patient gets approval in advance. Blue Cross and other health plans often farm out those reviews to companies like AIM. The insurance industry maintains such companies keep health care costs down and help patients by rejecting unnecessary and unproven treatments. Critics say the companies unfairly deny claims, noting that they market themselves to insurers by promising to slash costs.

In Salim’s case, AIM made decisions using its own guidelines, which it said at the time were based on medical studies and the recommendations of professional medical associations. AIM’s parent company, Anthem, renamed itself Elevance Health in 2022, and subsequently changed AIM’s name to Carelon Medical Benefits Management. In a statement, Elevance said that Carelon “uses evidence-based clinical guidelines to assess requests.”

At Blue Cross, Salim’s appeal started with a review by one of its own doctors, an ear, nose and throat specialist. He affirmed the denial using language taken directly from AIM’s guidelines.

The insurer then routed Salim’s request to an outside company called AllMed that it had hired to render expert opinions. A day later, AllMed’s doctor, a radiation oncologist, affirmed the decision to deny payment for Salim’s care. He, too, copied AIM’s guidelines in explaining his reasons. AllMed did not return requests for comment.

Not willing to give up, Fuller, Salim’s doctor, took a step physicians rarely do: He asked Blue Cross to have an independent medical review board unaffiliated with the insurer or AIM examine Salim’s claim. Louisiana’s Department of Insurance randomly selected the review company, Medical Review Institute of America.

Fuller didn’t skimp on evidence. He sent the company a 225-page request containing Salim’s medical records, MD Anderson’s evaluation and outside studies supporting the use of proton therapy.

The next day, the Medical Review Institute denied the claim. Its doctor, a radiation oncologist, not only quoted AIM’s guidelines, but also cited four studies that raised questions about the evidence for proton therapy. The Medical Review Institute did not return requests for comment.

In 19 days, five different people at four different companies had reviewed Salim’s case. Each had denied his request for treatment. Each had cited AIM’s guidelines. The appeal process was over.

Before the review was complete, Salim had decided to pay out of pocket for the proton beam therapy. “If there’s a tumor in there, and it’s growing, why are we waiting so long to do something?” he asked Fuller.

Over more than two and half months that fall and winter, Salim visited MD Anderson multiple times a week. At each radiation session, he strapped on a custom mask that covered his entire face. Nurses locked him into arm and leg restraints. Then he had to hold still for 45 minutes while the proton therapy machine thrummed around him.

In the background, he sometimes heard the nurses playing the 1977 Kansas song, “Dust in the Wind.”

“What a terrible song to play,” he thought.

On Dec. 24, he endured two sessions in a day to finish up. He had completed his treatments — a Christmas present to himself. But he wasn’t done fighting.

A Useful FriendshipA few months after recovering, Salim decided to sue Blue Cross to force them to pay.

There was one problem. Salim held a type of insurance governed by a relatively obscure federal statute: the Employee Retirement Income Security Act. The Department of Labor is charged with enforcing the law, known as ERISA.

The 1974 law is vague and lacks teeth. Court rulings interpreting this law have often tilted in favor of insurers. For instance, insurance companies have broad authority to decide what to cover and what to deny. And the law does not allow for punitive damages, which are designed to punish a company for abuse or fraud by eating into its profits.

Instead, patients who win ERISA cases get money to cover their treatment and the expense of hiring a lawyer. Nothing more.

Such cases do not, in other words, bring in the big dollars like those Salim had won in large personal injury lawsuits. Few attorneys in the country handle ERISA complaints. Salim said he talked with some of them. All told him his case was unwinnable.

But Salim had a secret weapon: his childhood buddy Ronald Corkern.

Salim grew up a few blocks away from Corkern in Natchitoches (pronounced “nack-a-tish”), a northwestern Louisiana town founded in 1714 and set high on the banks of Cane River Lake. Shops with wrought-iron balconies and columned galleries line the city’s red brick main road. Well-preserved slave plantations ring the outskirts.

The city is known for two things: “Steel Magnolias,” a 1989 movie about female friendships, was filmed there. And singer-songwriter Jim Croce and his entourage were killed when their plane struck a pecan tree near the end of the runway at the local airport.

Salim and Corkern left for different law schools, but both returned to practice in their hometown. They often found themselves on opposite sides of the courtroom, facing off in more than 100 trials, sometimes pulling pranks on one another.

Affable and deeply engaged in the civic issues of his hometown, Corkern had spent much of his life as a lawyer defending auto insurers. He had never before argued an ERISA case. But for his friend, he was willing to try.

“I got trapped into handling this case,” Corkern joked. At the end of February 2019, he sued Blue Cross. He started in state court, but Blue Cross quickly got it bumped to federal court in Alexandria, Louisiana, where ERISA law would apply.

Over the next several years, lawyers for Blue Cross argued that under the law, insurers had the ultimate authority to determine what to cover, and Blue Cross had decided that proton therapy wasn’t medically necessary in this case. Salim’s lawsuit, they contended, should be dismissed.

But prior court rulings had carved out an exception: If Corkern could prove that Blue Cross had committed an “abuse of discretion” — for instance, if it had blatantly ignored or twisted evidence supporting the therapy — the judge could force the insurer to pay Salim for his treatment.

A nine-page letter written by Fuller, Salim’s doctor, argued that very thing, criticizing the guidelines that AIM and Blue Cross had relied upon to deny payment.

AIM had cited 48 research studies to support its rejection of proton therapy. Fuller found only a few that pertained to head and neck cancer. One of those was out of date: It cited guidelines by a professional society of radiation oncologists that had subsequently been updated to support proton therapy for head and neck cancers.

And Fuller noted that AIM had “glaringly omitted” information from the National Comprehensive Cancer Network, an alliance of cancer treatment centers that included MD Anderson. In May 2017, the network issued guidelines that said the therapy was under investigation and noted that studies had indicated its potential in reducing radiation doses to critical nearby organs for some cancers. While proton therapy may have similar efficacy as other kinds of radiation treatment at eliminating cancer, studies have shown it generally has fewer side effects in treating sensitive regions of the body — a surgeon’s scalpel versus a steak knife.

Fuller’s touché: 17 academic studies (including some he co-authored) that supported the use of proton beam therapy. Several found significant decreases in radiation exposure and fewer side effects.

The therapy “minimizes toxicity for Mr. Salim, resulting in a more rapid recovery from the treatment of his cancer and less cost to him and you (as his insurer),” wrote Fuller, who declined to comment for this story.

Fuller’s letter played a big role in the case. A federal magistrate, Judge Joseph H.L. Perez-Montes, cited it 16 times in his 19-page opinion. Fuller showed that most of the evidence used by Blue Cross was “either outdated or did not pertain to the treatment of head and neck cancer,” Perez-Montes wrote. Blue Cross, he said, had “abused its discretion.”

A federal judge reviewed Perez-Montes decision and ordered Blue Cross to pay Salim for his proton therapy treatment.

Blue Cross appealed that ruling to the Fifth Circuit Court of Appeals in New Orleans. The company argued that the lower court had erred in accepting Fuller’s analysis over the insurer’s own experts. On May 3, 2023 — more than four years after Corkern filed the suit — a panel of judges ruled for Salim.

It is unclear why Blue Cross fought so hard to avoid paying Salim. In its appeal, the insurer told the court that the case involved an “important issue” regarding the interpretation of benefits under the ERISA law. It is unknown how much Blue Cross spent on the case. Corkern charged his friend the bargain price of $36,185.

The treatment worked. Salim has been cancer-free for almost five years, and he suffered few long-term side effects. His Creole accent now has a slight rasp to it. If his next checkup turns up no signs of a tumor, his doctors will consider him cured.

This year, he joined his friends for the U.S. Open again. And he’s found a new Goliath, joining other attorneys in a suit against the country’s largest pharmacy benefit managers — intermediaries in the buying and selling of medicines who have been accused of artificially inflating prices.

The Blue Cross lawsuit was the last one that Corkern ever filed. He spends most of his time these days conducting mediations between aggrieved parties.

The case itself remains open. The judges ruled that Blue Cross must pay for Salim’s treatment. But they did not say how much.

Salim is expecting the full $95,862.95 he paid. However, court records show that Blue Cross has said it only needs to pay Salim the discounted rate it had negotiated with MD Anderson at the time of his radiation treatment: $35,170.47. That’s what Blue Cross would have paid if its doctors had said yes in the first place.

A decision is expected later this year.

While not setting a precedent, the case may help persuade insurers and other courts that proton therapy is medically necessary in certain cases, legal experts said.

“They were wrong. Proton radiation is not experimental. It’s a wonderful tool,” Salim said. “If I played even a small part, it was a very successful lawsuit.”

Do You Have Insights Into Dental and Health Insurance Denials? Help Us Report on the System.

Insurers deny tens of millions of claims every year. ProPublica is investigating why claims are denied, what the consequences are for patients and how the appeal process really works.

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.