Barclays warns of costly scam that targets customers.

Barclays reports increase in scams as temperatures rise.

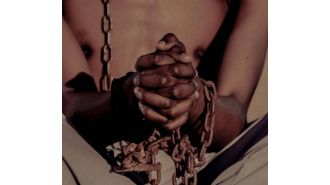

It's important to be cautious when someone you've never met in person starts asking you for money. While summer brings to mind images of beaches, t-shirts, and ice cream, it's also a prime time for something far less pleasant – scams. Last July saw a significant increase in the number of people falling victim to scams while searching for love. Interestingly, there were more reports of scams during that month than in February, which is typically associated with Valentine's Day and its potential for luring people back onto dating apps in hopes of finding a special someone to share overpriced pasta with.

According to new data from Barclays, the warmer weather seems to coincide with a rise in scams. In fact, there was a staggering 139% increase in the value of romance scam reports between May and June of this year, compared to the previous months of March and April. This data was gathered by analyzing scam reports from both business and personal bank accounts. While men make up the majority of these reports, it's women who typically lose more money. On average, female victims lose a whopping £8,900, while men lose around £3,500.

Scammers often target vulnerable individuals by pretending to be interested in a romantic relationship. Once they gain the victim's trust, they then proceed to ask for financial assistance. Barclays has issued a warning to anyone dating online to be on the lookout for these types of scams and to be extremely cautious if ever asked for money by someone they don't know very well. But it's not just those looking for love who are at risk – scammers have also been known to target people planning weddings. They do this by obtaining information about the wedding venue or suppliers and then sending fake invoices with their own bank details. To avoid falling victim to this type of scam, it's important to verify any new payment information before making a transaction.

Kirsty Adams, a fraud and scams expert at Barclays, stressed the importance of getting to know and verifying the identity of someone before transferring any money, regardless of the reason or how urgent the request may seem. In fact, according to additional research conducted by Barclays, men are more likely than women to transfer money to someone they've recently started dating, even if they haven't met in person yet. This goes against the stereotype that women are more susceptible to scams.

Barclays also conducted a survey of 2,000 individuals in June, which revealed some interesting findings. For instance, 34% of single people feel more inclined to try dating during the summer months. Additionally, almost a fifth of men admitted they would consider sending money to someone they were in an online relationship with, but had not yet met in person, compared to only 7% of women. Furthermore, almost a quarter of respondents said they have advised a family member or friend to stop online dating due to concerns over romance scams. And, unfortunately, a fifth of respondents personally know someone who they fear could fall victim to a romance scam.

Ms. Adams emphasized the need for collaboration between different industries in order to combat the rising number of scams. She also stressed that falling for a scam is nothing to be ashamed of and encouraged victims to report it to their bank and seek support from friends and family. Scammers often use sophisticated tactics and invest a significant amount of time in building a relationship and trust with their victims, so it's important not to let the stigma surrounding scams prevent victims from speaking out. Together, we can work towards preventing scams and protecting ourselves and our loved ones.