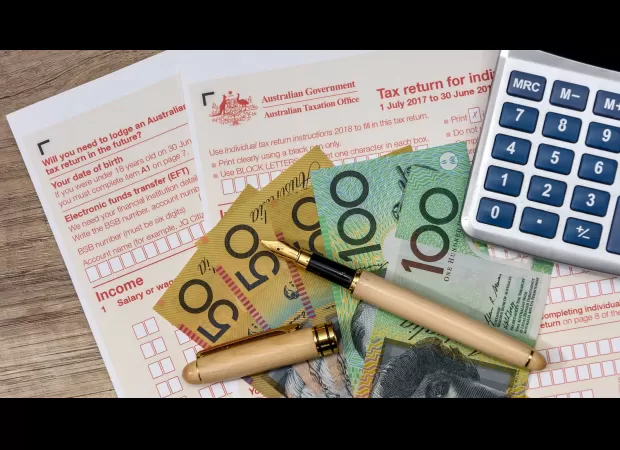

ATO advises Australians to prepare for tax changes before July 1.

Common mistakes include overclaiming deductions and providing incorrect contact or bank information.

Attention all Australians! The Australian Taxation Office has issued a friendly reminder to take your time when filing your tax return next week. They have noted that twice as many errors occur when returns are submitted in early July. It's important to avoid overclaiming deductions or providing incorrect personal or bank information, as these are common mistakes that can easily be avoided.

In case you're wondering why the rush to file in July, it's all because of the stage 3 tax cuts that will automatically give you a pay rise - without you having to ask for it! The ATO Assistant Commissioner, Rob Thomson, has kindly cautioned us all that "tax time is not a race". He explains that there is a higher risk of missing important details when returns are filed early, especially if you have multiple sources of income.

Thomson elaborates, "We often see errors where individuals who are in a hurry to file their returns forget to include interest from banks, dividend income, payments from government agencies, and private health insurance details." So, while it may be tempting to get your tax return out of the way early, it's important to wait until all necessary information is available.

Speaking of which, Thomson also reminds us that most of the information from our employers, banks, government agencies, and health funds will not be accessible until late July. So, it's best to be patient and wait for all the necessary details to come in before filing. He reassures those who prefer to get their tax return done and dusted, saying, "We understand that some individuals like to tick this task off their to-do list early and not think about it for another year. However, it's best to wait a few weeks to ensure everything is correct."

But, we all know that mistakes can happen, even when we take our time. If you do happen to make an error, don't worry! You can easily amend it through the ATO online amendment process on myGov or by reaching out to a registered tax agent. So, don't stress and take your time to ensure your tax return is accurate and complete. Happy filing, everyone!