A recent study shows that people using paycheck advance apps are being charged hidden fees.

A recent report reveals that customers are facing a 56% surge in overdraft fees on their checking accounts due to using an advance product.

April 7th 2024.

According to a recent analysis by the Center for Responsible Lending, many individuals who are struggling financially are facing additional hidden costs. These costs can be quite significant, with some consumers experiencing a staggering 56% increase in overdraft fees for their checking accounts when using an earned wage advance app to withdraw cash.

The Center for Responsible Lending, a nonprofit research and policy group, conducted a thorough examination of five popular cash advance apps: Brigit, Cleo, Dave, EarnIn, and FloatMe. Their findings showed that regular users of these apps were facing triple-digit annual interest rates, high levels of repeat borrowing, and an increase in bank overdraft fees after using the product.

Earned Wage Access (EWA) is a financial product that allows individuals to access their wages before their scheduled payday. This option is voluntary and is offered by various providers, including those mentioned in the CRL report. However, the CRL believes that these cash advance apps should be regulated as credit products, as they involve an agreement to receive money now and pay it back in the future, making them essentially loans.

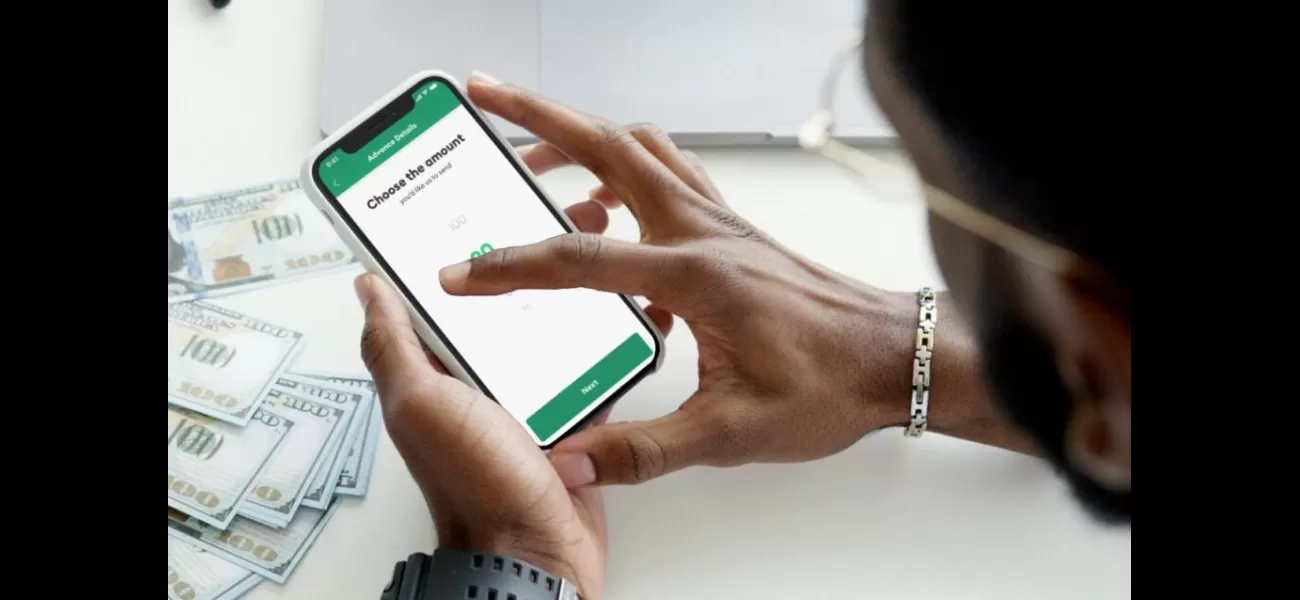

Typically, these apps can be accessed through a smartphone, where users can connect to their bank account or through an employer-provided benefit. These apps, often run by fintech firms and non-bank lenders, charge fees for their financial services, including cash advances.

The CRL report revealed some alarming findings, including the fact that consumers were repeatedly taking out advances and using multiple lenders frequently. In fact, 75% of consumers took out at least one advance on the same day or the day after repaying a previous one. This cycle of reborrowing can have a significant impact on an individual's financial stability, according to Lucia Constantine, the lead author of the report.

Moreover, the report showed that consumers who took out small amounts of cash were paying a high price. The average APR for an advance repaid in 7 to 14 days was a shocking 367%, almost as high as the APR on a typical payday loan, which is 400%. This not only adds to the financial strain on low- to moderate-income individuals but also makes it harder for them to catch up on expenses or save money.

Constantine emphasized that while earned wage access may seem like a solution to the income insufficiency faced by many American workers, it is, in fact, another high-cost credit option. The concept has become increasingly popular, with people collecting 55.8 million paycheck advances worth $9.5 billion in 2020, compared to only 18.6 million advances worth $3.2 billion in 2018.

The CRL report comes at a crucial time as policymakers in some states and in the U.S. Congress are considering exempting advance apps from consumer protection laws. This includes a vote by the U.S. House of Representatives' Financial Services Committee on legislation that would exempt these loans from the Truth in Lending Act, a move that the CRL strongly opposes.

Lucia Constantine stated that the data provided in the report clearly shows that cash advance apps are putting financially strapped consumers in an even worse position. She also expressed concern about policymakers ignoring this evidence and taking away legal protections from consumers, leaving them vulnerable to the harms of these advance apps.

In response to the CRL report, Phil Goldfeder, CEO of the American Fintech Council, stressed that EWA products are not loans and should not be regulated as such. He cautioned policymakers, regulators, and other researchers to view the findings of the report with caution and instead work with real consumer advocates to develop sound and data-driven policy recommendations that truly benefit consumers.

In conclusion, the CRL report sheds light on the hidden costs and potential harms of using cash advance apps, especially for those who are already struggling financially. It serves as a reminder to policymakers and consumers alike to carefully consider the impact of these products and work towards finding solutions that truly benefit all parties involved.

The Center for Responsible Lending, a nonprofit research and policy group, conducted a thorough examination of five popular cash advance apps: Brigit, Cleo, Dave, EarnIn, and FloatMe. Their findings showed that regular users of these apps were facing triple-digit annual interest rates, high levels of repeat borrowing, and an increase in bank overdraft fees after using the product.

Earned Wage Access (EWA) is a financial product that allows individuals to access their wages before their scheduled payday. This option is voluntary and is offered by various providers, including those mentioned in the CRL report. However, the CRL believes that these cash advance apps should be regulated as credit products, as they involve an agreement to receive money now and pay it back in the future, making them essentially loans.

Typically, these apps can be accessed through a smartphone, where users can connect to their bank account or through an employer-provided benefit. These apps, often run by fintech firms and non-bank lenders, charge fees for their financial services, including cash advances.

The CRL report revealed some alarming findings, including the fact that consumers were repeatedly taking out advances and using multiple lenders frequently. In fact, 75% of consumers took out at least one advance on the same day or the day after repaying a previous one. This cycle of reborrowing can have a significant impact on an individual's financial stability, according to Lucia Constantine, the lead author of the report.

Moreover, the report showed that consumers who took out small amounts of cash were paying a high price. The average APR for an advance repaid in 7 to 14 days was a shocking 367%, almost as high as the APR on a typical payday loan, which is 400%. This not only adds to the financial strain on low- to moderate-income individuals but also makes it harder for them to catch up on expenses or save money.

Constantine emphasized that while earned wage access may seem like a solution to the income insufficiency faced by many American workers, it is, in fact, another high-cost credit option. The concept has become increasingly popular, with people collecting 55.8 million paycheck advances worth $9.5 billion in 2020, compared to only 18.6 million advances worth $3.2 billion in 2018.

The CRL report comes at a crucial time as policymakers in some states and in the U.S. Congress are considering exempting advance apps from consumer protection laws. This includes a vote by the U.S. House of Representatives' Financial Services Committee on legislation that would exempt these loans from the Truth in Lending Act, a move that the CRL strongly opposes.

Lucia Constantine stated that the data provided in the report clearly shows that cash advance apps are putting financially strapped consumers in an even worse position. She also expressed concern about policymakers ignoring this evidence and taking away legal protections from consumers, leaving them vulnerable to the harms of these advance apps.

In response to the CRL report, Phil Goldfeder, CEO of the American Fintech Council, stressed that EWA products are not loans and should not be regulated as such. He cautioned policymakers, regulators, and other researchers to view the findings of the report with caution and instead work with real consumer advocates to develop sound and data-driven policy recommendations that truly benefit consumers.

In conclusion, the CRL report sheds light on the hidden costs and potential harms of using cash advance apps, especially for those who are already struggling financially. It serves as a reminder to policymakers and consumers alike to carefully consider the impact of these products and work towards finding solutions that truly benefit all parties involved.

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment