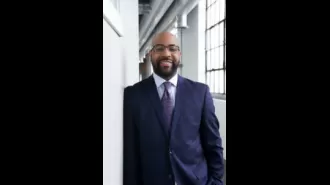

A 40-year-old retiree credits three books for changing his life and helping him save $3.6 million.

Robinson has a debt-free lifestyle thanks to his own strategic savings, investments, and cash on-hand.

March 3rd 2025.

Jamal Robinson is not your average retiree. At just 40 years old, he has already achieved a net worth of $3.6 million. But what makes Robinson stand out is not just his impressive wealth, but also how he achieved it and how he chooses to live his life now.

After leaving his job as a tech executive in generative AI, Robinson decided to settle down in Dubai. In an interview with CNBC's Make It, he shared his story of how he managed to retire decades before the typical retirement age. His millions are not just sitting in one place, but are spread out across savings, investments, and cash on-hand. And most importantly, Robinson lives a debt-free lifestyle that he built on his own terms.

But this was not an easy feat. Robinson credits three books for changing his mindset and helping him reach his goal. The first book that influenced him was "The Millionaire Next Door" by Thomas Stanley. It taught him about money management from an early age, emphasizing that having money does not mean you should spend recklessly. In fact, many millionaires are known for keeping a tight hold on their cash. This lesson inspired Robinson to save up to 90% of his earnings.

The second book that had a significant impact on Robinson was "Die With Zero" by Bill Perkins. Despite his million-dollar net worth, Robinson still saw himself as a "minimum wage guy." But this book allowed him to let go of his limiting beliefs and start using his money for more meaningful things. He set a goal to only use 5% of his investment portfolio, which amounts to $185,000 a year. With this money, he plans to travel and invest in experiences that promote his overall well-being.

The third book that shaped Robinson's money mindset is "The Psychology of Money" by Morgan Housel. This remains his top recommendation for anyone on a financial journey. The book is a collection of short stories that highlight how psychology plays a significant role in people's money habits.

But for Robinson, it wasn't just books that helped him achieve financial success. He also believes in having open conversations about finances and gaining new perspectives from others. He encourages people to ask questions and take advantage of the knowledge and experiences of those around them.

In the end, Robinson's story is a reminder that with the right mindset and determination, anyone can achieve financial freedom. And it's not just about accumulating wealth, but also using it wisely to create a life that brings happiness and fulfillment.

After leaving his job as a tech executive in generative AI, Robinson decided to settle down in Dubai. In an interview with CNBC's Make It, he shared his story of how he managed to retire decades before the typical retirement age. His millions are not just sitting in one place, but are spread out across savings, investments, and cash on-hand. And most importantly, Robinson lives a debt-free lifestyle that he built on his own terms.

But this was not an easy feat. Robinson credits three books for changing his mindset and helping him reach his goal. The first book that influenced him was "The Millionaire Next Door" by Thomas Stanley. It taught him about money management from an early age, emphasizing that having money does not mean you should spend recklessly. In fact, many millionaires are known for keeping a tight hold on their cash. This lesson inspired Robinson to save up to 90% of his earnings.

The second book that had a significant impact on Robinson was "Die With Zero" by Bill Perkins. Despite his million-dollar net worth, Robinson still saw himself as a "minimum wage guy." But this book allowed him to let go of his limiting beliefs and start using his money for more meaningful things. He set a goal to only use 5% of his investment portfolio, which amounts to $185,000 a year. With this money, he plans to travel and invest in experiences that promote his overall well-being.

The third book that shaped Robinson's money mindset is "The Psychology of Money" by Morgan Housel. This remains his top recommendation for anyone on a financial journey. The book is a collection of short stories that highlight how psychology plays a significant role in people's money habits.

But for Robinson, it wasn't just books that helped him achieve financial success. He also believes in having open conversations about finances and gaining new perspectives from others. He encourages people to ask questions and take advantage of the knowledge and experiences of those around them.

In the end, Robinson's story is a reminder that with the right mindset and determination, anyone can achieve financial freedom. And it's not just about accumulating wealth, but also using it wisely to create a life that brings happiness and fulfillment.

[This article has been trending online recently and has been generated with AI. Your feed is customized.]

[Generative AI is experimental.]

0

0

Submit Comment